Volatility Harpoon. What worked and what didn’t?

Sinclair Currie, Principal and Co-Portfolio Manager

There has been a lot written about the spike in volatility which saw share prices tumble in the last quarter of 2018. In this quarterly piece, we looked at how recent movements in share prices corresponded to changes in earnings expectations during the period. The most surprising observation from this analysis was the declining valuation premium for companies which enjoyed positive changes to earnings expectations. We believe this indicates that in response to greater economic and geo-political uncertainty, investors have sought exposure to companies with perceived quality and sustainability rather than singularly focussing on near term earnings momentum. The fact that size (‘larger’ small caps performed better) was a clear preference suggests indiscriminate selling from which opportunities arise.

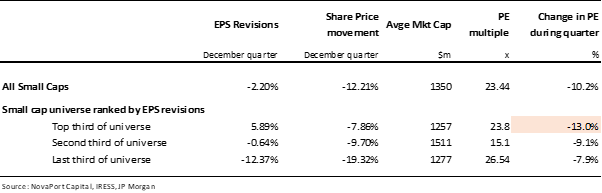

OBSERVATION 1: The market always wants good news – and now also something else?

The top third of the small industrials ranked by earnings per share (EPS) revisions delivered a pleasing 5.9% increase in earnings expectations in the last quarter of 2018. The bottom third saw expectations reduced significantly (down 12.37%). Overall share prices fell further than earnings, resulting in a de rating of valuation multiples across the board. Notably, the PER de-rating was greatest in the cohort which actually delivered upward EPS revisions. These companies ended the year on 23.8x earnings, down from 27.3x at the end of September 2018.

While exposure to positive earnings revisions insulated investors against the steepest share price falls, the 13% valuation de-rating indicates that the market had already priced for this and chose to take profits on good news. It might also indicate greater investor focus on downside protection which would be consistent with the idea that investors seeking refuge in perceived lower risk, higher quality names during times of uncertainty.

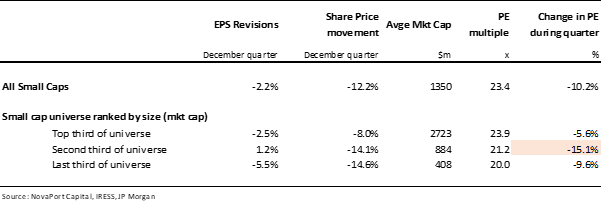

OBSERVATION 2: Stuck in the middle – size mattered

Size was a significant predictor of return during the period. The smallest stocks experienced the heaviest share price falls and also saw the most negative EPS revisions. However the ‘medium sized’ small caps (i.e. market capitalisation between $650m and $1300m) saw their valuation multiples fall the furthest, derating by 15% to 21x. This harsh derating was despite the cohort delivering the strongest EPS revisions during the quarter and is likely an anomaly which has created some investment opportunities.

We believe two factors drove the poor performance of size. Firstly, weaker liquidity in smaller names probably resulted in steeper share price moves as investors rebalanced their portfolios. Secondly, we suspect investors generally conflate size with quality. Growing concerns about the broader macroeconomic outlook may have seen some investors reduce their exposure to small and micro caps in the belief that these businesses will prove less resilient in a cyclical downturn.

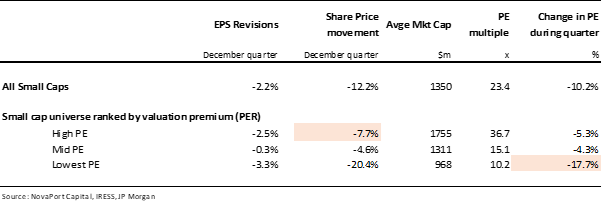

OBSERVATION 3: Boring became cool and value got crunched

The most significant de-rating occurred in value / low PER stocks. Looking at how stocks performed ranked by price to earnings multiples, companies with mid-range valuation multiples displayed the best returns in share price as well as earnings revisions – possibly boring was the flavour of the quarter. While the earnings revisions for stocks on low multiples were not significantly worse than for those on high multiples, the share prices underperformed significantly. Interestingly these low multiple stocks were on average significantly smaller than the average. Once again this indicates to us that investors have avoided stocks where they perceive lesser quality.

Conclusions

Earnings revisions and growth matter however we believe size was also a strong driver of small cap industrial returns in the last quarter of 2018. We believe nervous sentiment translated to investors seeking a balanced exposure between quality / earnings durability as well as growth which is probably sustainable while volatility and uncertainty are elevated. Larger companies might have more robust balance sheets and stronger market positions however we do not believe size always equates to quality. A smaller company might dominate its market or have a differentiated position in a growing market. To this end we see that the sell off during late 2018 has created some opportunities. The analysis highlights this might be particularly the case for ‘mid-sized’ small caps.