This retailer has been savaged on results but does it provide an opportunity?

The following article featured on Livewire, 06 February 2023.

Tim Binsted from NovaPort Capital runs the ruler over this retailer’s results and provides an outlook for the coming 12 months.

Specialty retail has been a tough place to operate over the past 12-18 months. Gone are the goldilocks conditions of the pandemic (at least from a retail perspective), where everyone was at home remodelling their living rooms and updating their décor. Replaced by an environment of higher interest rates, mortgage stress, and increased economic uncertainty.

The company we’re focused on today has been savaged by the market on the back of its latest results, perhaps unfairly, suggests Tim Binsted from NovaPort Captial.

I think it’s not surprising that we’ve had some moderation, but the market’s now extrapolating this going forward. It looks like a bit of an overreaction

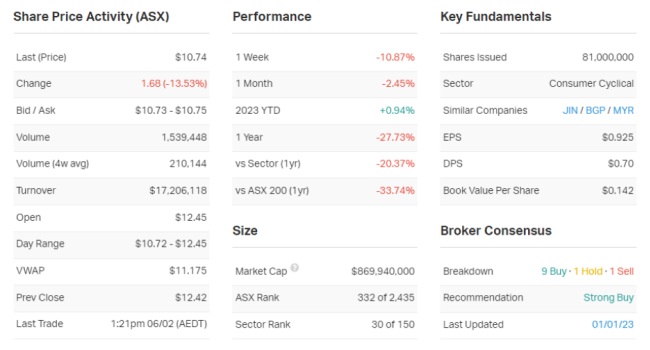

The stock in question is Nick Scali (ASX: NCK) and whilst the company’s results were much stronger than a year ago, with revenue and EBITDA up more than 50% each, written sales orders were down more than 12% on January 2022 – and that’s what has spooked the market.

The NCK share price performance has been solid since the June low, rallying from around $7 to north of $12 before today’s results. Join me as I dive into the results with Binsted and get his take on the prospects for Nick Scali as it continues to navigate the post-Covid retail landscape.

Nick Scali (ASX: NCK) H1 key results and company data

- Revenue $283.9m, compared to $180.3m a year-ago (+57%)

- EBITDA $112.2m, compared to $73m a year-ago (+54%)

- Orders $210.3m

- Interim dividend 40 cps, fully franked; record 7-Mar, payable 28-Mar

Note: This interview took place on Monday, 6 February 2023. NCK is a holding in the NovaPort Capital portfolio.

In one sentence, what was the key takeaway from this result?

It looks like the froth from the lockdown-driven boom in furniture sales has ended.

The stock is down 13% on the results. In your view, was it an overreaction, an under-reaction or appropriate?

I think it looks like a bit of an overreaction. I think we had the market jumping at shadows leading into the market lows with big fears about retail disaster. The whole sector sold off and then it rallied when trading was better than expected and it rallied quite hard into the result. Everyone was expecting that the boom in COVID sales couldn’t last forever. I think it’s not surprising that we’ve had some moderation, but the market’s now extrapolating this going forward. I think it’s jumped at shadows before, recovered and rallied.

And then now we’ve had one month that’s down from very high levels and the market’s jumping again. It looks like a bit of an overreaction

We’re there any major surprises in this result that you think investors should beware of?

No major surprises. We’ve all seen rising rates. We all knew there was a huge boom in sales during COVID per this category in particular, those comps were never going to last.

I don’t think it’s surprising that this was going to ease a bit at some point.

I mean, they’re [sales] not falling off a cliff. They’re still well up on pre-COVID. I wouldn’t have thought there’s a massive surprise in there. The main positive surprise would be how well they’re executing on the Plush acquisition.

Would you buy, hold or sell NCK on the back of these results?

RATING: Hold

Please note that NovaCapital currently hold this stock in its portfolio.

What’s your outlook on NCK and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

You’ve got to assume there’s going to be a continued easing in like-for-like sales just with the COVID heat coming off a bit.

I think you’d also expect that rising rates will put a little bit of a dent in as well, but you’ve got very strong employment, so that should support sales to some degree. As long as unemployment is below 4%, wages are still strong. That’s a mitigating factor. And then you should see them bank a lot of synergies from the acquisition of Plush, which is going really, really well. They’ve got one of the best management teams in the business executing that. They’ve got $20 million out already on a runway basis, and they’re getting the margins up in that Plush business. There’s 6-7% percentage points of margin that they’re getting through there.

I’d expect them to execute well on that and for that to drop through to the bottom line of the business.

I think the retail sector, generally, it is going to get tougher with rates going up. You’ve got a lot of fixed mortgages rolling off, it’s been well flagged, that’s going to hit consumers, but we’re coming off a really high base and the valuations aren’t that high for Scali and some of its peers. There’s a few offsetting factors there, but you have to say sales would have to be a bit less rosy, but it just depends on individual stocks and how they’re placed to manage that. There will be a little bit of top-line pressure, but it’s well-run business with good margins and a great acquisition to deliver synergies.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

RATING: 2-3

I think you’d have to say it’s pretty exciting. I think you probably have to say somewhere between a two and a three. And the reason that I’ve given you a range, I’d probably skew it more towards two. For cheapness, there is value, but we just haven’t really seen the earnings pressures yet. We’ve had a very good period for market earnings. I think we’ve had the PE come down, bit of a de-rate with the interest rate rises, and we haven’t seen the earnings pressure yet. Maybe we’re just starting to see a little bit of that through pockets of the market. I think you want to see a bit more of an adjustment there. Plus, we’ve had a big rally over Christmas and into February reporting, so that’s taken away some of the ultra cheapness out of the market.

But there’s opportunity. The market’s rebased a bit and it’s a good time to be investing.

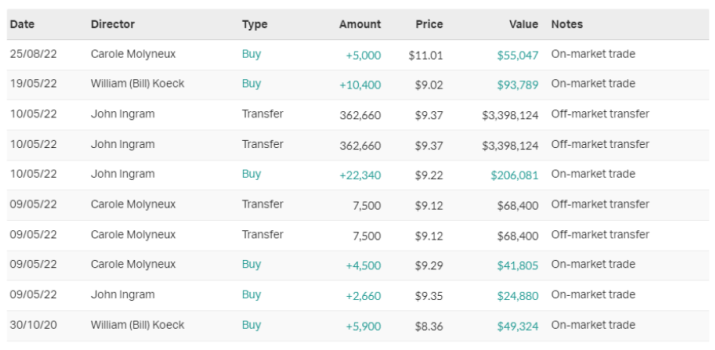

10 most recent director transactions

Author: Chris Conway, Managing Editor, Livewire Markets

This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656, AFSL 385 329) (NovaPort). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.