The Importance of Building Defence into a Small Cap Portfolio

Finding and investing in an emerging Australian success story is exciting. The prospect of higher share price returns into the near future is incredibly alluring. However, this high growth expectation of smaller companies also comes with increased risk of capital loss. From NovaPort Capital’s (NovaPort) perspective, managing the downside is just as important to finding growth opportunities when managing a portfolio of smaller companies.

Bubble, Bubble, froth then trouble!

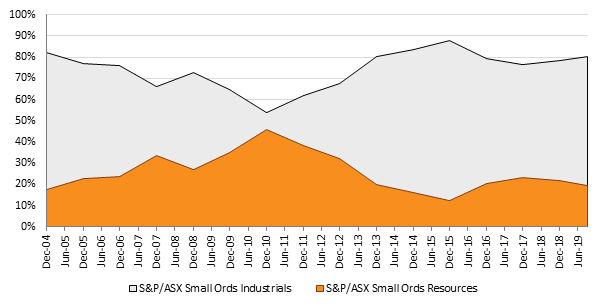

Bubbles and fads often start and grow in the small end of the market. These can have a large distortion on the mix of companies that make up the Smaller Ordinaries index which are broadly between $500m market cap to $3 billion in size. These sector dislocations or bubbles often reflect themes that are occurring in the broader economy. An example is the growth of the small resource sector during the resource boom from 2003 -2010. This is demonstrated in the chart below. At its peak in 2010, small resources made up close to 50% of the market weighted ASX Small Companies Index.

Figure 1. Industrial & resources exposure in the small ordinaries index

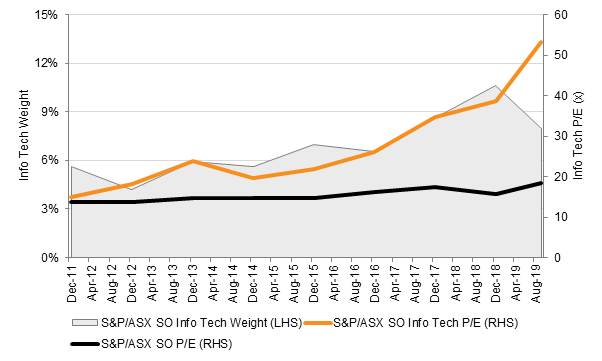

Fast forward to today, smaller technology companies are currently at their all-time high in terms of market weight. The number of new listings on the ASX is dominated by technology companies. The chart below shows the effect of the growth in the market cap weight of the Small Cap Tech sector over the last 8 years. The bars show the growth in the weight in the index. The line indicates the forward valuation (P/E) ratio that the sector is trading on. Not only has the technology sector valuation tripled, the exposure to these stocks has also increased. This has reduced recently to some degree due to the graduation of a number of high profile tech names (WiseTech Global, Appen) graduating to the S&P/ASX 100 index.

Figure 2. S&P Small Ordinaries Information Technology Sector Weight of the Small Ordinaries (LHS) and Valuation (RHS).

Avoiding trouble by ironing out bubbles

To avoid these bubbles and dislocations in the smaller company market, NovaPort use several portfolio management techniques which help build defence into a small company portfolio. These include:

- Assess and invest in the total return forecast not the relative return of each investment

- Invest in companies based on their profitability, not thematic concepts

- Invest in stable, high cash generative businesses

It may seem like common sense but in using these rules we aim to rule out speculative companies and reduce the likelihood of large unintended sector tilts. The outcome is a more diversified portfolio of smaller companies that is generally less volatile than the market. Although not as exciting, from NovaPort’s experience this approach has delivered a superior long-term outcome for our investors.1

The benefits of a conservative, less volatile approach

Using these techniques, NovaPort aims to provide a strategy that captures the majority (around 85%) of the upside yet only capture 60% of the drawdown. This tilted return profile generally results in a smoother ride for investors without sacrificing longer term performance. Smaller companies are cyclical, but over time companies supported by real earnings and supportive multiples are likely to recover. By growing off a higher capital base, any recovery is more likely to lead to outperformance in the longer run.

Along with the performance benefit for an adviser and their clients, a less volatile approach reduces the risk of exposure to behavioural finance biases such as loss aversion. Loss aversion is a reference to the bias that the fear of losing money outweighs the benefits of making money.

Investors have a tendency to panic during periods of large drawdowns. By reducing that downside by 40%, this approach can reduce the risk of a client wishing to liquidate a position at the wrong time without allowing the market cycle to recover.

At what point in the market cycle will this approach outperform other smaller company strategies?

The approach used by NovaPort has shown to not outperform over the entire market cycle. The strategy is likely to underperform when large bubbles or fads occur, as outlined above, or at the later stages of a bull market. The time in the cycle when this approach is likely to outperform other smaller company portfolios is when markets fall, and then subsequently rebound.

Although it is not as exciting, NovaPort believes managing a portfolio conservatively and consistently is far more important than being part of the latest exciting next big thing.

For additional information about NovaPort, please contact your local representative.

1 The NovaPort Smaller Companies Fund has delivered 13.8% p.a since 31/12/2002 (net of fees). This is +6.1% above the ASX/S&P Small Ordinaries benchmark. Past performance is not a reliable indicator of future performance.

This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656, AFSL 385 329) (NovaPort), the investment manager of NovaPort Smaller Companies Fund and NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS for the Funds, issued by Fidante, should be considered before deciding whether to acquire or hold units in the Funds. The PDS can be obtained by calling 13 51 53 or visiting www.fidante.com. Neither Fidante nor any of its respective related bodies corporate guarantees the performance of the Funds, any particular rate of return or return of capital. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.