2019 Small Caps Review & 2020 Preview

Sinclair Currie, Principal and Co-Portfolio Manager

You should read the Fund’s Target Market Determination (TMD) and the Fund’s Product Disclosure Statement (PDS) to ensure the key attributes of the Fund as described in the TMD and PDS aligns with your objectives, financial situation and needs. These documents are available on the Apply Now page on this website.

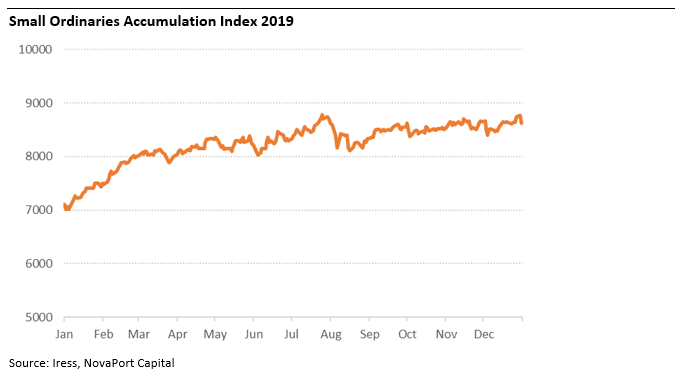

After a rocky end to 2018, markets surged throughout 2019 fuelled by improving sentiment and easy monetary policy. The Australian small companies sector joined the party with the index returning in excess of 21% (including dividends). Overall price gains outpaced earnings revisions, the result; equity valuations are extremely high. At the outset of 2020 investors face an unattractive choice between higher risks associated with stretched valuations or pitiful real returns on cash.

What performed well in 2019

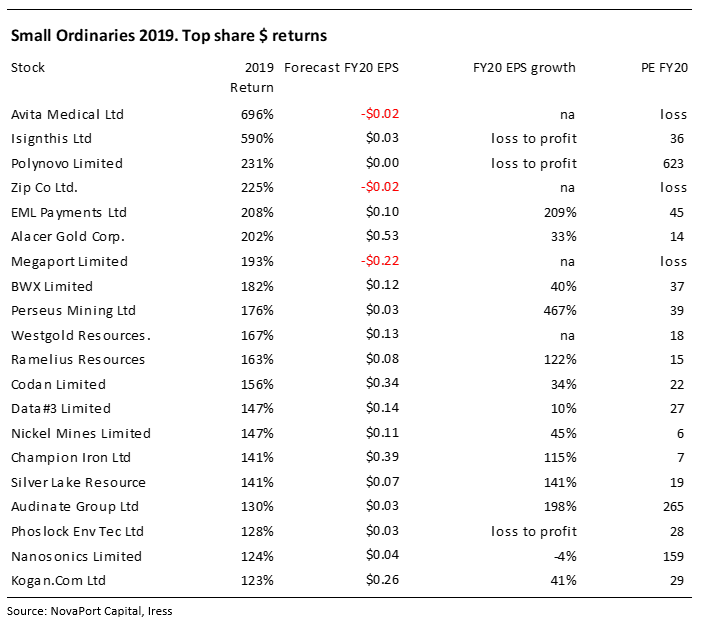

We took a snapshot of the twenty best performing stocks in the Small Cap benchmark in 2019. Resource stocks accounted for seven of the top twenty and five of these were gold miners. The gold sector was a clear outperformer, aided by a 20% rise in gold prices. Six of the top performing stocks were loss making in FY19 and three of these are expected to continue to lose money into FY20.

Unsurprisingly the best performing industrials are expected to generate strong EPS growth in FY20 with average growth in excess of 100%. Earnings multiples for these companies ranged from a low of 22x to a high of 623x. Healthcare / biotech stocks were strongly represented, followed by fintech.

In summary the market’s appetite for risk was high in 2019, rewarding businesses well in advance of earnings delivery or even revenue generation. The strong performance of the gold price also indicates to us an appetite any alternative to cash as a store of value. We think the strong performance of Bitcoin during 2019 lends support to this explanation.

What didn’t perform well in 2019

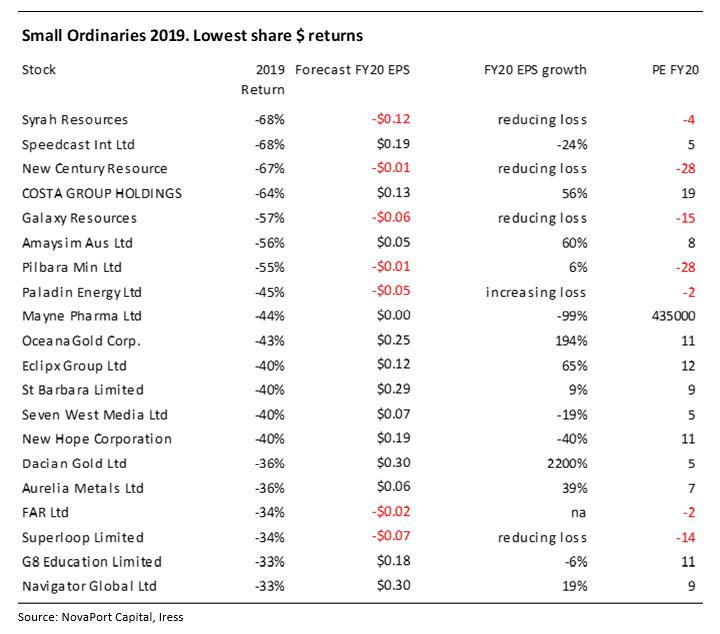

The twenty worst performing members of the small ordinaries benchmark in 2019 included eleven resource stocks. Some gold companies experienced operational disappointments and the share price weakness for other resource companies was explained by weaker commodity prices (e.g. coal, lithium, graphite).

Seven of these companies are expected to lose money in 2020, albeit the market mostly expects the size of these losses will reduce. Thirteen companies in this group are expected to report a profit in 2020. Surprisingly only five of them are expected to see profits shrink. The remaining companies are forecast to generate incongruously high earnings growth, which tells us the market has limited confidence in these forecasts.

Valuations in this cohort are substantially lower than those observed among the outperforming stocks. This is not surprising given the limited confidence in earnings forecasts for this group of companies. In many cases these companies require a substantial turnaround in operational performance. Pinpointing such inflection points is difficult. While the differential in valuations reflects a justifiable caution towards turnaround stories, we suspect it also reflects inflated optimism towards those stocks with positive momentum.

Domestic news in 2019

Australian Federal Election

The May 2019 federal election was a significant event however without a change in government the result did not greatly impact small companies last year. The alternative election outcome would have had a more meaningful impact, as the market would have had to reckon with sweeping transformations to taxation.

The uncertainty associated with the prospective tax changes had a significant impact on the residential construction sector. Construction activity levels are yet to meaningfully recover. Small companies exposed to residential construction currently face weak demand. The market anticipates demand will improve as rising house prices in the second half of 2019 incentivises developers to restart construction.

Monetary Policy

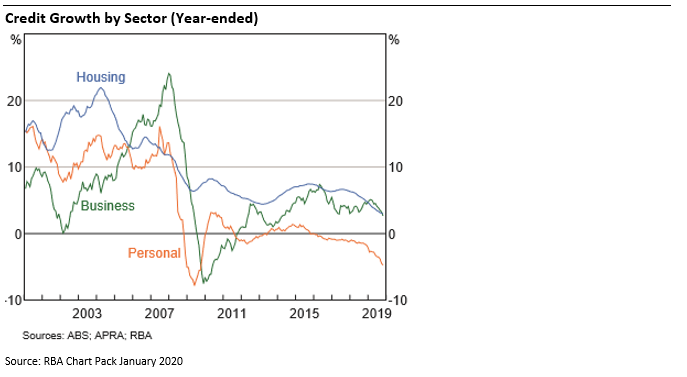

2019 was a remarkable year for monetary policy. It took the RBA only five months between May and October to halve the cash rate to a scant 0.75%. RBA leaders have also canvassed alternative (and unconventional) policy options such as quantitative easing, signalling their willingness to stimulate even further. In July APRA provided its own stimulus with looser prudential guidance for residential mortgage lending. Despite APRA’s assistance (and rebound in home prices) residential housing credit growth remains below pre GFC levels.

Overall credit has grown at a persistently slower pace in Australia than experienced prior to the GFC. The RBA has acted decisively yet money supply and credit have responded weakly relative to the past. There is little consensus about why this has been the case. It may reflect a lack of confidence by borrowers, or lenders, or demographic shifts, or some other unknown.

We do not doubt that the changes in monetary policy had an impact on Australian small companies. Investors have been forced to re-consider their asset allocation in order to generate returns and companies have been provided with incentives to invest. This has driven up share prices and supported merger and acquisition activity.

International news in 2019

Federal Reserve

The US Federal Reserve also delivered looser monetary policy in 2019, initially through lower interest rates and later via providing liquidity to the repo market in order to boost reserves in the banking system. Banks have been able to use these newly created reserves to increase their lending activity. We believe banks most expeditiously increase lending to loans secured by liquid assets such as equities or bonds. Therefore the initial impact of new lending enabled by the Fed’s repo operations has been to boost markets, including Australian small companies.

China and Trade

While Australia’s financial markets are closely tethered to the USA, China exerts a vital influence on the broader economy via trade. The pace of China’s economic expansion is clearly moderating which appears to have been a carefully managed process. Overall Australia’s exports continued to benefit from robust Chinese demand however there were some variances. For example, strong pricing for iron ore was offset by weaker prices for coal and LNG.

Late in the year the market’s anxiety about trade between the USA and China was calmed by progress in negotiations. Few forecasters believe this reflects a final resolution to the trade tensions between China and the USA, however the market has been encouraged by recent co-operation. Despite the progress of negotiation the trade conflict is an enduring source of uncertainty for Australian small companies across a broad range of industries. For example, technology and telecommunications companies need to re-engineer their infrastructure and supply chains while commodity exporters face the risk of disruption via exclusion from preferential trade deals.

Outlook 2020

Since the GFC debt levels have shifted between sectors however overall global debt has remained high. This has been supported by generous monetary stimulus which is expected to persist into the foreseeable future. It is important to note that the positive outlook for markets is built on a longstanding foundation, i.e. a conviction that central banks have capacity (and credibility) to forestall deleveraging (e.g. the “Fed put”). This is a meaningful issue within Australia, where credit (and money supply) growth have trended lower despite aggressively lower interest rates.

We observe prevailing consensus is 2020 will be a positive year for markets and risk assets. This view is supported by the positive growth outlook (globally, however particularly in the USA) and in turn by accommodating monetary policy. Central banks appear unlikely to respond to an uptick in inflation, so rising interest rates appear to be off the table.

Also supporting the outlook is an expectation that the USA government will deliver as much good news as possible in the lead up to this year’s elections. Having claimed credit for the bull market, it will be eager to preserve it.

There is a logical sequence underlying the positive outlook for 2020 however we remain wary that the future always retains the capacity to surprise. To this end we remain cautious of investments priced for perfection, particularly where the underlying growth dynamics are mature and possibly waning. The likelihood that central banks will allow economic growth to ‘run hot’ provides some support for cyclical sectors, many of which have lagged the bull market. We have sought to position the portfolio in some of these names where we see attractive entry points and limited downside risks.

This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656, AFSL 385 329) (NovaPort), the investment manager of NovaPort Smaller Companies Fund and NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS for the Funds, issued by Fidante, should be considered before deciding whether to acquire or hold units in the Funds. The PDS can be obtained by calling 13 51 53 or visiting www.fidante.com. Neither Fidante nor any of its respective related bodies corporate guarantees the performance of the Funds, any particular rate of return or return of capital. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.