Private equity swoops on undervalued companies

Sinclair Currie, Principal and Co-Portfolio Manager

After a fallow period for M&A in the Australian market, takeover activity picked up in March. Invocare, Estia Healthcare, United Malt and Liontown Resources all announced that they had been approached by potential acquirers. The combined value of these offers was close to $10bn.

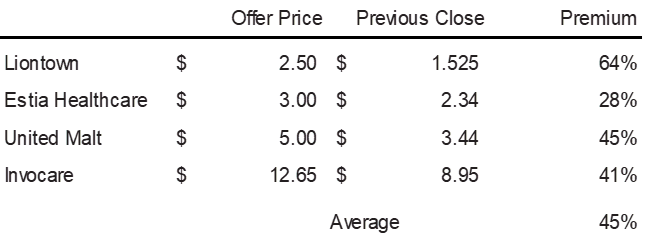

As is the norm, the offers were both indicative and conditional on further due diligence. The proposed offer prices were at reasonable premiums to prevailing share prices, ranging from 28% to 64% and on average 44%. In good news for shareholders, the offers were made on a cash basis.

Private Equity groups featured prominently. Estia’s bid was from Bain Capital and Invocare’s from TPG. The offer for United Malt was from Malteries Soufflet, which is part owned by alternative asset manager, KKR. In contrast, Liontown’s bidder was Albemarle Corporation, a rival Lithium producer.

All four companies operate in industries which are capital intensive. Estia (aged care) and Invocare (funeral services) own substantial real estate portfolios while United Malt (brewing) and Liontown (lithium miner) require ongoing investment in large scale industrial plant and equipment. While Liontown’s mines are not yet operational, Estia, United Malt and Invocare operate mature and at scale businesses with strong and resilient cash flows. The last three of these are all holdings in our portfolios, the types of businesses that we think offer compelling value for investors, notwithstanding a takeover offer. These cash generative businesses with wide economic moats are particularly attractive given none are directly nor substantially exposed to slowing consumer discretionary spending.

Are the bids compelling?

The price premiums are attractive enough to warrant consideration from the boards of each target company, in our view. However, the terms and conditions will be telling. It is a troubling thought that private equity can access, non public information as part of their due diligence BEFORE making any investment. In essence, bidders are requesting a free option to acquire the company, subject to finding out information outside the public domain. A level playing field requires that no investor has access to inside information. All investors risk their capital when making an investment, offering preferential access to non-public information to one class of investor does not seem equitable.

It is highly informative that these bids are all for companies which require heavy investment in fixed capital and physical assets. This suggests an appreciation by the bidders that

- the replacement cost of these assets is underappreciated by the market, and

- higher costs of capital will reduce the threat of new entrants into these markets

The bids are also a timely reminder that equity markets are not always efficient. Market dislocations and the short term focus of equity markets participants provides opportunities for bidders who see a compelling outlook for sectors that were previously ignored. Adapting to a world of higher inflation and nominal interest rates has implications not only for the availability of capital but also for competitive dynamics.

It may be the case that the substantial pools of unallocated cash that private equity has built up in recent years is finally finding a home. Irrespective of whether the takeovers go ahead or not, offers on the table have boosted the share prices of target companies materially.

This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656 AFSL 385 329) (NovaPort), the investment manager of the NovaPort Smaller Companies Fund and the NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.