AUB Group

Mitch Ryan , Senior Analyst

You should read the Fund’s Target Market Determination (TMD) and the Fund’s Product Disclosure Statement (PDS) to ensure the key attributes of the Fund as described in the TMD and PDS aligns with your objectives, financial situation and needs. These documents are available on the Apply Now page on this website.

Our stock in focus for this quarter is AUB Group (up until December 2015 the company was known as Austbrokers Holdings). The stock represents one of our most significant positions within the Smaller Companies Fund. While we have held the stock for several years now, we thought it was pertinent to highlight the stock this quarter for two reasons:

- it is beginning to benefit from a tightening rate cycle that has historically lasted ~4 years; and

- we do not believe the market is currently pricing in the long-term growth that the Risk Services division stands to generate.

AUB group is one of Australia and New Zealand’s leading providers of risk management, advice and solutions for small and medium sized enterprises (SME’s). In short, AUB group looks to be a trusted adviser of SME’s with regards to insuring their business. A key differentiator to the AUB Group structure, from its peers, is that it operates under an owner-driver model. This ensures that all echelons of the organisation are aligned in delivering outcomes in the best interest of its clients and shareholders.

NovaPort has held AUB group for a significant period of time through both up and down periods. While we have long been believers in the quality and strength of the core business we believe that the stock is entering a prolonged period of macro-economic tailwinds. Further to this we see the stock as benefitting from the investments that it has made in diversifying its earnings over the past four years.

Aligned interests

While not an essential part of our investment process, one that we like to see, is an alignment of interests between ourselves as investors and senior management teams as shareholders. As such, the owner-driver business model that AUB Group employ is in tune with our ethos. At the models heart AUB Group aims to own 50% of its roughly seventy underlying insurance broker businesses. This ensures that each of the operators of those businesses manages it as their own – keeping costs to appropriate levels, investing for growth, maintaining strong customer relationships and generating dividends for all owners.

A tightening cycle

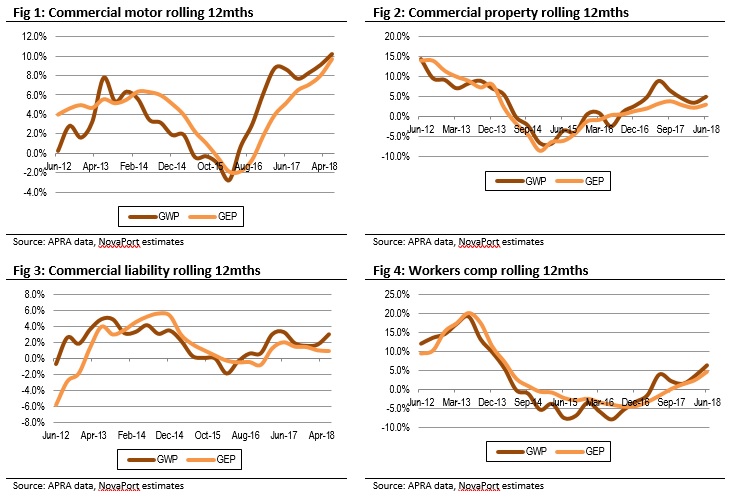

The bulk of AUB Group’s earnings are directly related to insurance broking, and by corollary the premiums being charged on insurance lines. Having endured a prolonged period of soft premium rates the market is now experiencing a hardening environment. Although AUB Group does not provide a breakdown of its exposure to individual commercial insurance lines Figures 1 to 4 below clearly demonstrate the rising tide in premiums. AUB Group is forecasting premium growth of 5% per annum for FY19 and FY20.

The insurance broking industry has experienced modest earnings growth in recent years as a result of a soft insurance rates cycle. During this time AUB Group has focussed on productivity of its operations and increasing volume to grow its earnings base. When you couple this with the fact that historically the rate tightening cycle has been a multi-year event we believe that AUB Group is positioned at the start of a multi-year earnings growth period.

More than just an insurance broker

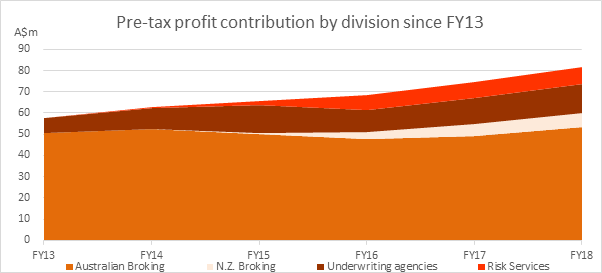

While the expectation of a tightening rate cycle is arguably already baked into the AUB share price, for us the under appreciated component to the business that will deliver long-term value for shareholders is the company’s Risk Services division.

AUB Group has diversified its business over the past two years by building a significant presence in the risk services industry enabling it to win work cover and return to work business. This broadens its offering to business operators and allows it to further demonstrate its knowledge of risk within client businesses. With structural changes ongoing in the allocation of work cover cases in NSW, that will result in larger amounts of work being allocated to a smaller number of providers, we see this as being an area of growth for the medium to long-term.

Fig 5. Layering of multiple earnings positions AUB for Growth.

Source: NovaPort Capital; AUB Group – Full Year Results Presentation, 27 Aug 2018.

Risks to consider

Whenever considering an investment in a stock we look not only to the upside cases, but the risks to our investment thesis to ensure the risk reward balance is appropriate. In this instance the stock specific risks we are currently monitoring are outlined below.

- Management change

Mr Mark Searles the current CEO and Managing Director has announced his intention to step down from his position in mid-October 2019 following the completion of the FY19 financial year. This comes on the back of a transition of the CFO role with Mr Mark Shanahan appointed in April 2018. Rapid fire management changes can sometimes be symptoms of underlying turmoil within a company. That said, we do not see these changes as fitting into this category given: they have been well flagged; allow the board significant time to conduct thorough searches for replacements; and have appropriate periods of overlap that ensure smooth handovers within the role. Further, we believe that Mr Searles leaves the company well positioned to benefit from the rising rate cycle and ready to enter its next phase of growth.

- Tightening cycle doesn’t appear/takes longer

At this point in time the tightening rate cycle is largely anecdotal and is yet to be seen making a significant impact on AUB Groups earnings. The pace of tightening and ability to push through sustainable price rises to customers will be key to the rate of growth in the short-term.

- Changes to icare return to work services in NSW impacting Risk Services earnings

The NSW government is currently implementing changes to the icare system and the way that work is allocated to return to work services. AUB Group has flagged that these changes may result in either a delay or loss of case load work while the transition occurs. This workflow equates to ~50% of the earnings within the Risk Services division. While AUB Group continues to diversify its risk services earnings geographically and defend its case load volumes where possible through employer preferred engagements, there remains a risk that the short-term impact will present a challenge to the company meeting its FY19 earnings guidance. With management maintaining the FY19 earnings guidance so far so good. Nevertheless, this remains a key risk for investors in AUB Group.

Summary

So in summary, we thought AUB Group was an interesting stock to highlight as our quarterly stock in focus as it:

- has a good underlying business where the interests of the business are aligned with shareholders;

- it continues to grow and diversify its earning base in prudent and logical ways; and

- it operates in a sector that is set to benefit for the medium term from macro-economic tailwinds.

Mitch Ryan, Senior Analyst