Data #3

Alex Milton, Principal and Co-Portfolio Manager

You should read the Fund’s Target Market Determination (TMD) and the Fund’s Product Disclosure Statement (PDS) to ensure the key attributes of the Fund as described in the TMD and PDS aligns with your objectives, financial situation and needs. These documents are available on the Apply Now page on this website.

A contemporary business 40 years in the making

Data #3 is an IT services company with a rich history dating back almost 40 years. It has been a long term investment for the NovaPort Microcap Fund having initiated a position in 2005.

The company listed in 1997 and now has over 1,100 employees and has extended its services capability beyond Queensland into other states. It posted over $980m in revenue last financial year and net profit after tax of $13.6m.

Data #3 has been able to grow over the decades by navigating multiple technology waves that have dramatically altered not just the types of products and services clients use but, just as importantly, the business model companies like Data #3 must adopt to stay relevant as the service provider.

Read the long term trends and adapt accordingly

Whereas in the past Data #3 may have been viewed as a “box reseller” selling and installing hardware and software on client premises for a small margin, it has evolved to more a solutions provider where hardware or software sales are more the means to the end.

Over time successful IT services companies like Data #3 have been able to migrate from being essentially technology hardware and software resellers to managed services facilitators often taking on critical functions that historically were largely undertaken by the IT departments of clients.

This requires a complete change in mind set from being a sales driven organisation with a focus on volume, scale and logistics to being solutions driven where the ownership and location of the actual hardware and software is less relevant to the client than the desired business outcomes.

These days the conversation with the client is more about how Data #3 can design and implement a solution to facilitate the client’s need for mobility (IT across multiple devices, anywhere and at all times), cloud (IT storage and applications housed and managed offsite) and security. The client can then focus on core business while knowing there is a flexible, scalable and nimble IT capability running in the background which is managed by a trusted partner such as Data #3.

Transformation in the P&L as well

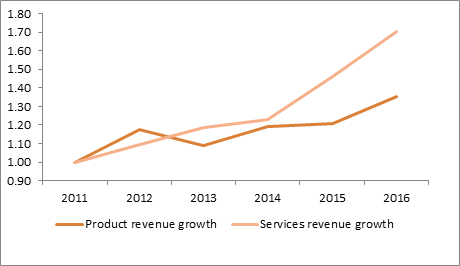

The impact of this on the company is clearly evident in the profit and loss statement. Up until say 15 years ago its revenue line would be dominated by lumpy one off type product sales. As expected, margins were thin reflecting limited opportunity to value add and industry wide competitive pressures. Fast forward to now and while product sales are still very important, they have been relatively flat since 2012 while services revenue has expanded at double digit levels.

Product sales last financial year amounted to $794m (6% compound growth since 2012) while Services revenue has grown by 11% per annum over the same time to $187m. As the chart below shows, since 2010 Services related revenues are over 70% higher while Product sales are up 35% over the same period.

Source: Data #3 2016 Annual Report

In addition, services revenue can be recurring in nature (subscription revenues) which is a coveted attribute for investors given improved visibility and lower volatility compared to the swings and roundabouts of product sales.

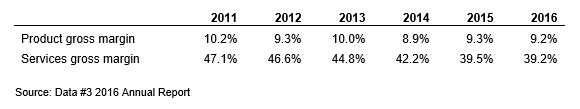

More importantly, and despite the impact of constant competitive pressure on margins, a contemporary services offering where companies like Data #3 are taking on a much more strategic role than in the past means the profitability margin on services revenue is generally a lot higher than the margin earnt on a simple hardware resale.

Meanwhile, the company maintains a strong balance sheet with virtually no debt and very high cash levels. The Microcap Fund has enjoyed the benefits of consistent, fully franked dividends over a long period of time in addition to the capital gains.

Risks to consider

NovaPort believes one of the biggest risks was the undertaking to transform Data #3 from a “box reseller” to a provider of more complex and strategic outcomes based services solutions to the end market. While still early stages, Data #3 has made more than solid progress without jeopardising the balance sheet or just as importantly, it’s hard won reputation in the market place.

Nevertheless, we constantly monitor the following specific to Data #3.

- Business confidence levels. No doubt businesses large and small understand the imperative to have IT systems and technology platforms that customers, employees and suppliers see as contemporary especially as more commerce migrates online. Having said that, when macro conditions get tough, what were considered “must spend” IT related items have a tendency to become discretionary and therefore subject to delays.

- Government as a client. Data #3 derives a significant portion of its revenues from government bodies. As such spend can be subject to broader budgetary decisions and similar to the above, can see delays or in some cases cancellations, due to non-renewal of a contract or re-allocation of funds to different initiatives.

- Client and contract risk. The risk that Data #3’s solution design or implementation falls short of expectations resulting in a dispute and non-payment. Potential to impact reputation as well as risk of financial costs should litigation eventuate.

- Technology. One of the investment appeals for NovaPort has been the opportunity (realised through the business model transformation described above) to benefit from the outsourcing trend as well as the evolution in technology driving demand for mobility, security and cloud to leverage the internet. For now its opened a huge opportunity set for Data #3, but there always remains the risk that the next wave, whatever that may be, will marginalise the company.