Resources – dead cat bounce or has something changed.

Sinclair Currie, Principal and Co-Portfolio Manager

Market Recap

During the September quarter 2015, the Australian Small Ordinaries continued to play on the swings and the roundabouts, trading within a range defined over four years past. The benchmark lost 7.5% of its value over the first two months of the quarter, then a rally commenced in September which trimmed these losses to 3.9% for the quarter. Once again, selling pressure was concentrated on resources stocks, which suffered a hefty 25% aggregate decline over the quarter while industrials were flat.

Much of the weakness in the resources sector can be explained by ongoing concerns surrounding the health of the Chinese economy. The Chinese stock market collapsed by nearly 27% over just 10 days during August. The US and local share market mirrored this mini collapse to varying degrees. Another notable external influence during the quarter was US monetary policy, where expectations for the timing of an increase in the Fed funds rate were again extended.

Despite market gyrations, earnings results posted by smaller companies during August were on the whole in line with expectations and certainly better than those reported over recent years. This is consistent with our view that the market’s current expectations are generally achievable and realistic, which we believe represents a sound foundation for investors. The US quarterly earnings season is underway at the time of writing and the coming weeks will provide an update on the health of many global industries.

Hefty falls in commodity prices and the Australian dollar over the last year have had a substantial impact on the underlying profitability of many companies in our universe. Much of this has been reflected in share prices however as the dust settles it is inevitable that investment opportunities will emerge.

Resources – dead cat bounce or has something changed.

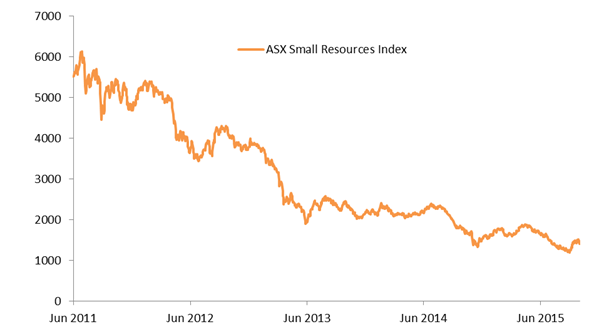

Since hitting a post GFC peak of nearly 7000 in January 2011, the ASX Small Resources benchmark subsequently lost 80% of its value by the end of September 2015. Alongside these falls, the Small Ordinaries benchmark weighting to resources has slipped from nearly 50% at its peak to barely 20% today.

ASX Small Resources Index

Source: IRESS, NovaPort Capital

Recently we have seen a sharp rally in small resource stocks however coming from such a low level this represents a minor recoup of the ground lost over the past five years. Resources have rallied by a similar magnitude several times over the past five years and each time resumed their downward trend shortly thereafter. Is this rally yet another ‘dead cat’ bounce, or does it represent a trough?

Valuation support?

The valuation argument supporting resource equities is mixed. Share prices of resource companies are trading at a fraction historic highs however the underlying earnings of these companies seem unlikely to return to the booming levels enjoyed five years ago, making historical price an unreliable metric. We prefer Discounted Cash Flow methodologies which are commonly adopted to estimate the value of a small resources company. On this measure we calculate the largest, most liquid names in the sector are trading on average at about a 20% discount to their value estimates.

However digging deeper into these valuations it quickly becomes apparent that for many of these companies, future earnings estimates are tied to an improvement in the underlying earnings of the business and in most cases this is expected to be driven by higher commodity prices in the future. One needs to take a view on the outlook for the relevant commodities in order to make an informed investment in a resource company.

Commodity prices – fundamental driver for equities

The market price of a commodity is an outcome of demand and supply. In the recent boom, strong growth in China was a huge engine driving demand for a diversity of commodities ranging from iron ore to dairy products. Moderating Chinese growth, combined in many cases with an untimely surge in supply has seen prices fall. Prices can continue to fall indefinitely until demand exceeds supply and sadly few commentators expect a return to the strong demand growth enjoyed during China’s boom. This leads us to look more closely at the supply side.

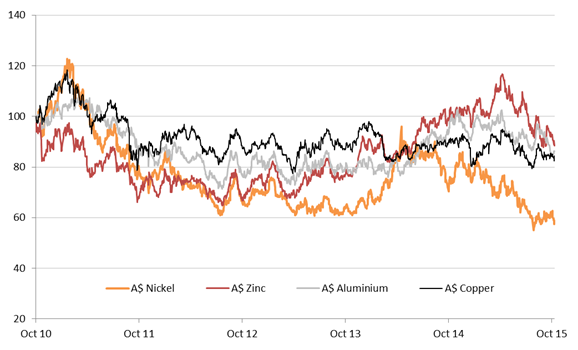

Base metals – relative performance (Australian dollar denominated)

Source: IRESS, NovaPort Capital

For a number of commodities a growing proportion of suppliers are losing money at current prices. In the extreme cases of aluminium and nickel, it is estimated that about half the world’s primary supply is not economic at current prices. Clearly this is not sustainable and must eventually lead to suppliers going out of business.

We believe cuts to mine supply are a signal that prices are close to a nadir. Encouragingly we are already seeing some signs of supply cuts occurring in the market place, two prominent examples being Glencore’s recently announced cuts to its zinc mining operations, and the Indonesian Government upholding the ban on laterite nickel ore exports.

The reality of supply curtailment underlies our confidence that there is limited downside for some commodity prices and also for the share prices of those companies with operations which are profitable even at current depressed commodity prices. Limited downside is an encouraging investment feature however NovaPort’s methodology is also to seek investments where we see 50% upside over three years. We also need to be able to justify why commodity prices should rise within our three year time frame.

On our analysis, nickel stands out offering a strong likelihood of recovery within the next three years. The extent to which supply has been, an continues to be curtailed, the outlook for demand and the recent declines in inventories all point to a supply constrained market within our investment time horizon.

Conclusion

The small resources sector is a fraction of its former value due to a negative shift in the fundamentals underpinning many commodity prices. Valuations seem relatively attractive and while we do not see much downside from here, upside for the resources sector as (a whole) would probably require stronger than expected global demand growth.

In the absence of demand strength exceeding forecasts the sector does not seem likely to return to its historic highs soon. However selectively we are able to identify some investment opportunities in the sector. We identify companies with quality nickel mining operations as the most prominent of these opportunities.