Case Study: No Point Riding the Investment Rollercoaster…Unless it’s for the thrill of it

Smaller company investing is certainly at the more exciting end of the investing spectrum. A smaller company’s earnings and profitability can grow quickly off a low base and given the link between share prices and earnings, so does the share price. Small companies with minimal earnings can easily be caught up in the hype of blue-sky opportunities for either new emerging technology or sector tailwinds such as an extended commodity boom. However, a smaller company will generally have less diversified revenue sources, greater dependency on single suppliers and a lower level of liquidity, which can lead to sharp declines in the share price.

Smaller companies can offer a large range of share price movements over a given period, otherwise known as volatility. A highly volatile security is one that hits new highs and lows, moves erratically, and experiences rapid increases and dramatic falls. Volatility can have a negative impact on investment performance. It can be one of the major reason’s an investors’ long term returns fall far short of expectations.

The following case study will examine the outcomes of investing in one of the more volatile, popular stocks in the smaller company benchmark, and compare it to a company that demonstrates a very low level of volatility.

Case Study: Highly volatile company share price vs a company with low volatility

Companies: MyState Limited vs BWX Limited

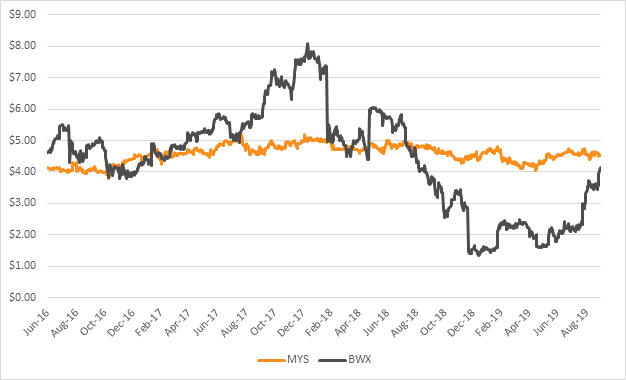

Two companies have been selected in a case study on the impact they can have for an investment portfolio. Over the last three years, the outcome for investors in these companies has been very different. Both starting and ending in relative similar positions, the path for one of the companies has been a lot wilder than the other.

These companies are both industrial companies with a similar market capitalisation, however they are different in nature. One company is in consumer products and the other provides financial services.

- BWX Limited (ASX: BWX) is a small industrial company that manufacturers body, hair and skin care products. The company produces and distributes moisturisers, oils, lotions, scrubs, creams and other related products. BWX has a good stable of brands and good geographic diversity. However, execution from management has come up short several times which has caused an increased level of volatility as investor expectations has not been met.

- MyState Limited (ASX: MYS) is a credit union. They are headquartered in Tasmania and its main activities include banking services, trustee services and wealth management. It has an attractive yield with relatively stable earnings compared to other stocks in the diversified financial and broader index. They have enough capital to fund long term growth and gradually increase its dividends.

The BWX share price is significantly more volatile than MYS. This is outlined in Figure 1 below.

Figure 1: Share price performance of MyState Limited (MYS) and BWX Limited (BWX) since 30 June 2016

Why volatility destroys wealth

Table 1 below shows why the concept of volatility can destroy wealth. Following a volatile year in 2017 for BWX, the value of both investments at the end of the financial year were broadly the same, up around 20% from the initial investment.

Table 1: Annual share price performance of MYS and BWX since 30 June 2016. Price return only.

Following an earnings downgrade in early 2018, BWX proceeded to lose 68% of its value in the FY19 financial year. The result of this was the initial investment at the end of the following financial year was worth $3,959. In this instance, the investor’s investment capital was materially impacted. At its peak in January 2018, the investment in BWX was worth $17,500.

In the current financial year to the end of September 2019, the share price has recovered 126.3%. However, the point of this case study is to demonstrate it is by far more difficult to recover to a previous high-water mark or a return target when the share price returns begin to recover. Put another way, the subsequent positive returns (+126.3%) are made on less money, therefore the investor is losing money with each cycle of volatility. The magnitude of the drawdown will determine how fast it will be to get back to the pre drawdown level of wealth.

MYS also experienced a difficult FY19, falling 10.4%. However, as the drawdown has not been as significant, this has meant that the financial impact was also less.

In an instance where the required rate of return over a 3-year period was 50% for both these investments, it is almost twice as hard for BWX to reach that total return outcome from the current share prices. (Required return for BWX is 67.4% vs 36.6% for MYS). To achieve this required return target, everything must work in the company’s favour from here on in.

Managing a portfolio of smaller companies

Reducing the risk of buying a highly volatile company can be managed by diversification and discipline. A portfolio of companies diversified across different industries and regions will naturally reduce any stock specific negative impact. In addition to this approach, NovaPort Capital use a disciplined process of selecting companies that have high certainty of earnings stability and a likelihood of delivering a 50% total return for the investment over the next 3 years. This absolute return criteria will effectively screen out highly speculative companies that are likely to prevent the portfolio managers from achieving this objective.

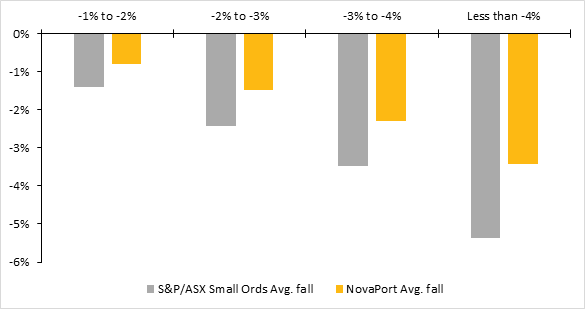

Figure 2 below shows the daily price falls of the S&P/ASX Smaller Companies Index since 2002, the inception year of the NovaPort Smaller Companies Fund (the Fund). When measuring the unit price falls, the Fund has typically only fallen 55% of the magnitude of the ASX Small Ordinaries when it has experienced a negative period. This strong downside captured by the Fund generally gives investors a head start when the market recovers.

Figure 2: NovaPort Smaller Companies Fund vs. S&P/ASX Small Ords. Negative Daily Unit Price movements since 2002

In conclusion

Volatility or large share price fluctuations is a feature of smaller company investing. What this case study of two different stocks shows is volatility can destroy wealth very quickly in a portfolio of investments. By holding a superior downside capture to the market, and selecting fewer volatile stocks, this enables the portfolio to have a strong head start when prices and markets rebound. The aim of this approach is to provide meaningful long-term absolute returns for investors.

This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656, AFSL 385 329) (NovaPort), the investment manager of NovaPort Smaller Companies Fund and NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS for the Funds, issued by Fidante, should be considered before deciding whether to acquire or hold units in the Funds. The PDS can be obtained by calling 13 51 53 or visiting www.fidante.com. Neither Fidante nor any of its respective related bodies corporate guarantees the performance of the Funds, any particular rate of return or return of capital. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.