Think Childcare

Alex Milton, Principal and Co-Portfolio Manager

You should read the Fund’s Target Market Determination (TMD) and the Fund’s Product Disclosure Statement (PDS) to ensure the key attributes of the Fund as described in the TMD and PDS aligns with your objectives, financial situation and needs. These documents are available on the Apply Now page on this website.

Growth company with an improving industry outlook

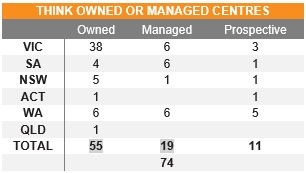

Think has developed or acquired and manages 74 childcare centres, up from 44 at the time of the IPO with 11 more currently in the pipeline. The centres are predominantly located in Victoria although it has expanded into other states over time and we would expect this geographic diversification to continue. As at the end of last year, over 6,600 children were in care at Think owned or managed centres, up over 80% in the last two years.

Management aligned with shareholders and a unique business model to facilitate expansion

Management execution has been a highlight for us since the company listed. The founding CEO owns nearly 16% of the company and has direct industry experience going back nearly 20 years.

An interesting feature of the business model and a big part of the growth strategy is the “incubator model” – these are the “Managed” centres in the table above.

In effect, a separate company (incubator) develops childcare centres from the ground up taking on all the risks and start up losses which are to be expected for any early stage business. Think’s listed entity manages these centres on behalf of the incubator in exchange for a management fee. There is an agreement between the incubator and Think that when the centre matures (occupancy above 75%) and is profitable, Think will acquire the centre on a pre-agreed valuation multiple (four times earnings). At this point the centre is transferred out of the incubator and becomes a wholly owned Think centre.

Under

this structure, Think shareholders aren’t exposed to start up risks

(operational, staffing, low occupancy) or the financial losses as a centre

moves to maturity. However, down the track shareholders get the benefit of a

new centre added to the portfolio that has been acquired on a good earnings

multiple, is profitable, and is already well known to Think management.

Get the priorities right and the rest follows

Think’s priority on the welfare of children and quality of services is something we’ve seen in evidence since the company listed. Discussions with management over the years highlights broader initiatives as well as a focus on the smaller things to ensure standards are maintained at a high level.

As shareholders we are confident Think will continue to invest in property, people and systems in order to maintain a high level of service rather than being overly focussed on maximising this year’s profit number at the risk of adverse issues arising down the track as a result.

The investment in acquiring the Nido Early School brand and three centres in 2017 is evidence of management’s willingness to go the extra step to provide a higher standard of service. In summary, Nido centres offer a “premium” service based on the “Reggio Emilia” childcare philosophy which embraces stronger relationships with families, environmentally aware physical spaces and early learning programs more attuned to empowering children.

Over time, all of Think’s centres will transition to the Nido program with 21 centres already converted.

Industry headwinds subside after a challenging period …. Favourable dynamics for the medium term

The broader industry has faced some issues over the last few years. Driven by relatively low cost of capital and the appeal of the sector as increasing workforce participation rates drive demand for childcare centres, developers have over invested in the sector. A higher number of centres in some regions has increased the number of available spots to the point where pricing and occupancy levels have been adversely impacted.

However, with more opportunistic developers exiting the sector given financial constraints, supply growth is moderating while at the same time government funded assistance (Child Care Subsidy) to families is supporting demand. As such, we think the industry dynamics have improved recently after a tough period which augurs well for medium term earnings growth.

Financially disciplined approach to balance sheet management

Given the potential to grow the network from what is still quite a small base, Think will require higher levels of debt over the forecast period. Escalating levels of gearing is always something we look at closely given the assumption higher debt will fund higher earnings which we know isn’t always the case in hindsight. However, we have achieved a level of comfort with management and their view of gearing over the last few years.

In addition, we haven’t seen any behaviour by management to indicate they are being too aggressive in expanding whether it be a rush to reach a large number of centres too soon or a preparedness to overpay for acquisitions which invariably result in unfavourable outcomes.

On broader financials, we forecast strong double-digit earnings per share growth over the forecast period and estimate 23c per share in 2021.2 A number of brokers are below us at 20 to 21c which at the lower end implies a multiple of just over 8 times which we consider appealing given strong earnings growth, stable profitability margins (in the mid-teens), high return on capital and manageable debt.

1. Returns reflect individual stock performance and are calculated before Fund fees have been deducted. No allowance is made for tax when calculating these figures.

2. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved.

The information contained in this document is current as at May 2019 and is provided by NovaPort Capital Pty Limited ABN 88 140 833 656, AFSL 385 329 (NovaPort). It is intended solely for holders of an Australian Financial Services License or other wholesale clients (as defined in the Corporations Act 2001 (Cth)). It must not be passed on to retail clients. Any information provided or conclusions made, whether express or implied, do not take into account of any person’s objectives, financial situation or needs. Because of that, each person should, before acting on any this information, consider its appropriateness, having regard to their objectives, financial situation and needs. Past performance is not a reliable indicator of future performance.

Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante Partners) is the responsible entity and issuer of interests in the NovaPort Smaller Companies Fund (ARSN 094 601 475) and NovaPort Microcap Fund (ARSN 113 199 698) (the ‘Funds’). Offers of interests in the Funds are contained in the current relevant product disclosure statements (PDS) issued by Fidante Partners which are available on our website www.fidante.com.au. The relevant PDS should be considered before making any decision whether to acquire or continue to hold units in the Fund.

The information in this document is not intended to be relied upon as a forecast or research and is not a recommendation, offer or solicitation to buy or sell any securities or to adopted any investment strategy, nor is it investment advice. Neither Fidante nor NovaPort makes any representation or warranty as to the accuracy of the data, forward-looking statements or other information in this material and shall have no liability for any decisions or actions based on this material. In preparing this document, NovaPort has relied on publicly available information and sources believed to be reliable, however, the information has not been independently verified by NovaPort. While due care and attention has been exercised in the preparation of the presentation, NovaPort gives no representation, warranty (express or implied) as to the accuracy, completeness or reliability of the information. The information in this presentation is also not intended to be a complete statement or summary of the industry, markets, securities or developments referred to in the presentation. NovaPort is not licensed or authorised to provide tax advice. We strongly recommend that an investor seek professional taxation and social security advice for their individual circumstances. Any examples used are for illustration purposes only. Any opinions expressed in this presentation, including as to future matters, may be subject to change. Opinions as to future matters are predictive in nature and may be affected by inaccurate assumptions or by known or unknown risks and uncertainties and may differ materially from results ultimately achieved.