Saracen Mineral Holdings

Mitch Ryan, Senior Analyst

You should read the Fund’s Target Market Determination (TMD) and the Fund’s Product Disclosure Statement (PDS) to ensure the key attributes of the Fund as described in the TMD and PDS aligns with your objectives, financial situation and needs. These documents are available on the Apply Now page on this website.

Super charging it’s production profile

We have chosen to highlight Saracen Mineral Holdings (Saracen) as our stock in focus this quarter, a stock we hold in the NovaPort Smaller Companies Fund. We have held Saracen in our portfolio for more than ten years.

Saracen is an Australian based gold producer that, following the acquisition of 50% of The Super Pit, owns three gold producing centres all within a 300km radius of Kalgoorlie in the mining friendly jurisdiction of Western Australia.

The exposure to gold within managed fund’s more broadly has often served as a hedge against inflation and historically has provided a stabilising influence during turbulent financial markets. That said, we do not approach an investment in a gold stock any differently to any other stock in our portfolio – we remain focused on the company’s balance sheet strength, earnings profile and management capability in order to minimise downside risk. As such, we own Saracen for its quality assets, long-term growth profile, and experienced management team.

Quality Assets delivering a strong growth profile

Saracen’s three primary assets, in order of time operated by the company, are:

- Carousue Dam Operations (CDO);

- Thunderbox Operations (TBO); and

- KCGM Super Pit Operations (The Super Pit).

The Carosue Dam operations process ore from the Karari and Dervish underground mines, satellite open pits and stockpiles. We forecast that the current investment in increased mill capacity will increase production to the range of ~240koz/annum.

The Thunderbox operations process ore from the main open pit and satellite open pits. The operation is transitioning to higher grade underground mine feed in the near future which we see being able to increase production to ~160koz/annum.

In November 2019 Saracen acquired 50% of the Super Pit from Barrick for A$1,100m. The Super Pit complex is a large scale open pit operation that is supplemented by higher grade underground feed on the edge of Kalgoorlie in Western Australia. While the operation has historically produced >700koz/annum at all-in-sustaining costs of ~A$1,000/oz following a pit wall failure in FY19 production has abated to <500koz/annum at AISC of ~A$1,500/oz.

The Super Pit super chargers the production growth profile

One month after Saracen acquired its 50% holding in the Super Pit, Northern Star (NST) validated the purchase when it paid A$1,130m for the other 50% share. We believe that Northern Star acquiring the other half of the asset delivered value to Saracen as the two new management teams are heavily aligned to maximise the value from the Super Pit. We see several areas for production and asset life to exceed the current expectations of the market, namely:

- optimized pit wall rehabilitation sooner than the current FY24 timeframe;

- accessing higher grade underground material (e.g. from Fimiston South where a large drill program is currently underway); and

- increasing the current mine life via increase Reserve & Resource estimates.

The Super Pit operations have been under new management for less than a quarter, so it is too early for Saracen and Northern Star to be outlining their views on the pit wall rehabilitation process to the market. That said, both companies are working in tandem to assess the information available and to plan a way forward. All options appear to be back on the table, and both are cognisant that any incremental improvement in the time to return to full production rates will have a material impact on the company’s production profile.

We see two further areas of growth at The Super Pit. Firstly, an ongoing drill program targeting Fimiston South has the potential to support increased underground productions. And secondly, the reporting of Reserves and Resources to Australian standards are likely to delineate a longer mine life.

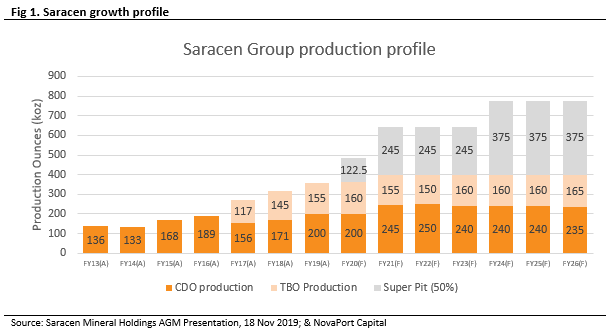

We forecast that these operational initiatives will see the company’s production grow from ~350koz in FY19 to ~800koz/per annum in FY24, with the potential for this to be achieved sooner.

From its humble position as a 130koz producer in FY13 Saracen’s growth trajectory has seen it become one of the largest gold producers by volume and market capitalisation outside the ASX100. The company’s growth profile to ~800koz is likely to see it attract a new set of investors.

Asset quality matters, but so does management quality

The quality of a management team is often hard to quantify, however, consistently outperforming guidance while not sacrificing the long-term growth of the company are good indicators from our perspective. The current management team of Saracen has built a strong reputation in the market for delivering consistent production from its assets while investing in those assets to deliver long term upside for investors all without risking the balance sheet.

Summary

We believe that Saracen’s recent acquisition of 50% of the Super Pit operations has provided a step change in the company’s production profile and diversified its risk across multiple production centres. We remain attracted to the stock for its quality management team and ability to increase production while extending mine life.

The information in this article is current as at the date of publication and is provided by NovaPort Capital Pty Ltd ABN 88 140 833 656 AFSL 385329 (NovaPort), the investment manager of the NovaPort Smaller Companies Fund ARSN 094 601 475 and NovaPort Microcap Fund ARSN 113 199 698 (the Funds). It is intended to be general information only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider the applicable disclosure document or product disclosure statement (PDS) and any additional information booklet for the relevant Fund before deciding whether to acquire or continue to hold an interest in the relevant Fund. The relevant PDS can be obtained from your financial adviser, Fidante Partners’ Investor Services team on 13 51 53 or website www.fidante.com.au. Please also refer to the Financial Services Guide on the Fidante Partners website. Past performance is not a reliable indicator of future performance. Neither your investment nor any particular rate of return is guaranteed. Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante Partners), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante Partners in relation to the Funds, Fidante Partners is not responsible for the information in this publication, including any statements of opinion The information is not intended to be relied upon as a forecast or research and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy, nor is it investment advice. Neither of Fidante Partners nor NovaPort makes any representation or warranty as to the accuracy of the data, forward‐looking statements or other information in this material and shall have any liability for any decisions or actions based on this material. Neither of Fidante Partners nor NovaPort undertakes, and is under any obligation, to update or keep current the information or opinions contained in this material. The information and opinions contained in this material are derived from proprietary and non‐proprietary sources considered by Fidante Partners or NovaPort (as applicable) to be reliable but may not necessarily be all‐inclusive and are not guaranteed to be accurate.