iSelect

Sinclair Currie, Principal and Co-Portfolio Manager

NovaPort initiated a position in iSelect earlier this year.

iSelect aims to act as “Australia’s life admin store” providing expert advisory services covering products such as insurance, utilities and personal finance. Having undergone a management transition within the past 12 months, with the internal promotion of Scott Wilson to CEO, the company is refocussed on its product offering.

The company operates in the online product comparison sector and compares private health insurance, life insurance, car insurance, broadband, energy, home loans and financial products. It maintains three brands: iSelect (www.iselect.com.au); InfoChoice (www.infochoice.com.au); and Energy Watch (www.energywatch.com.au).

The company generates the majority of its revenue from fees or commissions paid by product providers for successful sale of their products.

Reported operating revenue for the 2016 financial year was $171.9m, up 9% on the prior year. That said, we would emphasise the positive earnings momentum the business generated in the second half given the first half earnings were impacted by costs associated with restructuring the business. For us the most pleasing aspect of the recent result was the diversification of the income streams across iSelect’s newer businesses.

We are attracted to iSelect, as an investment opportunity, due to its position as trusted advisor to important life decisions. We are drawn to the company’s ability to further grow its existing areas of business and ongoing diversification of products on which it provides advice. We are attracted to the low capital requirements and cash generative nature of the iSelect business model.

Longer term valuation opportunity

While it’s already posted a high single digit return in its first quarter in the fund, we look at iSelect with a longer term perspective (ie, minimum 3 years). We don’t expect material share price upside from current levels in the short term, however we remain confident that our 50% return target will be achieved should current trends in revenue diversification continue.

Our view on the longer term value of iSelect is predicated on two core platforms:

- Operational turnaround.

In late FY15/early FY16 iSelect made a decision to increase components of its cost base to try and drive sales within its Private Health Insurance division. The expected sales did not eventuate, resulting in poor financials and a management refresh. The revised management team have focussed on matching the costs to the revenue, improving the technology platform and adjusting the brand direction. All of these had a significant impact on the performance of the company in the second half of FY16 and have placed the company in a position of strength from which to grow. - Diversification of revenue streams.

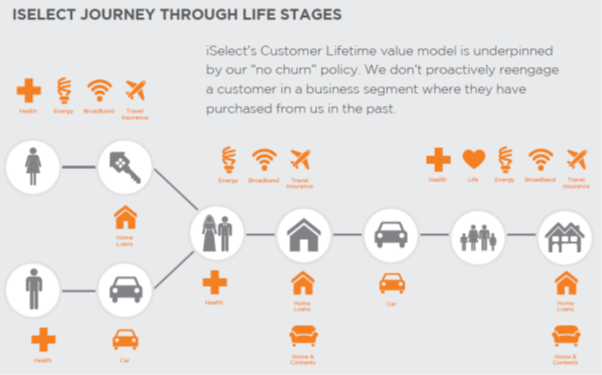

iSelect has focussed on expanding its offering beyond its core private health insurance comparisons and, as such, has diversified the revenue streams to life insurance, car insurance, broadband, energy, home loans and financial products. We see opportunities for iSelect to further diversify its product offering.

The diversification of the revenue stream has two key benefits:

- It reduces the impact of the revenue cyclicality associated with end of tax year private health insurance shopping; and

- It allows iSelect to utilise its position as a trusted advisor for financial products across a broad offering. Expanding its position across a customer’s life span as per the diagram below.

Source: iSelect 2016 Annual Report, 17 October 2016

Risks to consider

There are a number of risks that we will monitor going forward regarding our investment in iSelect:

- Regulatory.

Each of the main product markets in which iSelect provides its comparison services is subject to varying degrees of government policy and regulations. There is a risk that governments may from time-to-time make changes to regulatory policy. - Competition.

The markets for insurance, personal finance, home loans, broadband and energy products in Australia are competitive. iSelect not only competes against intermediaries and brokers selling products in the relevant product markets as well as product providers who are not using iSelect as a distribution channel, but who instead market to consumers directly through traditional media and/or branches or centres. In addition, iSelect may also face significant competition from potential new entrants to the Australian online comparison sector. - Product breadth.

Business units have varying levels of reliance on key product provider relationships. Key product providers may make fewer products available, may not make certain products available or may not make any products available to iSelect. - Customer traffic.

A decline in the level of traffic to iSelect’s website and call centre could have a material adverse effect on the company’s ability to generate commissions and fees from the sale of product through its websites as well as on its relationships with product providers.