A microcap revving the Growth Engine: HRL Holdings

Written by Tim Binsted, Analyst

One of the best things about fishing in the microcap pond is finding the tiddlers that can grow into tomorrow’s whales.

Laboratory and environmental services business HRL Holdings is capitalised at just over $55 million, and the journey of ASX-listed peer ALS Limited (capitalised at more than $6 billion) gives some indication of the market opportunity.

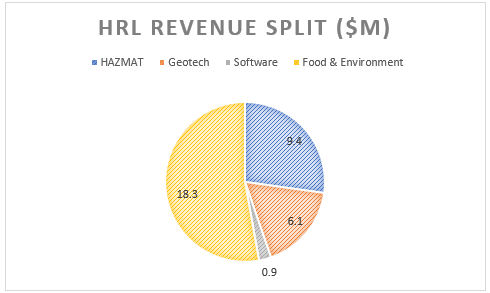

HRL’s Food & Environment segment offers analytical chemistry testing to New Zealand’s dairy and honey sectors for quality, hygiene, and disease monitoring purposes.

The environment side is more exposed to construction and project work through its testing of soil and air and for traces of contaminants like asbestos and drugs of abuse.

The HAZMAT arm contains the Precise and Octief consulting operations that perform services like soil sampling, contamination assessments, and dust and air monitoring.

HRL also has a small software business, Octfolio, and a geotechnical testing business focused on the Queensland civil and construction market.

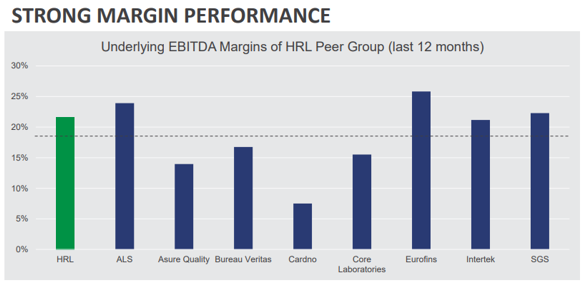

Unlike many early-stage businesses, HRL is already profitable.

This meets a key criterion that NovaPort Capital looks for in emerging companies: cashflows that can fund growth without the downside risk associated with many high-growth, high cash-burn businesses.

In fact, HRL generates margins that are very healthy when judged against a peer set of much larger businesses.

Several Growth Paths to Walk

HRL has a strong balance sheet with negligible debt, and after paying the final earn-outs associated with its acquisition of Analytica, free cash flow is available to fund further growth.

We believe there are strong tailwinds behind HRL’s testing capabilities in areas like food and water quality, and environmental hazards that provide fertile ground for growth capital.

There are three main paths for growth:

- Investment in existing operations such as new tests, better lab equipment, or new regions

- Bolt on acquisitions to add new services lines or new customer segments

- A large transformational acquisition to rapidly build scale and capability

All three of these avenues are being pursued.

The recent acquisition of Water Testing Hawkes Bay in New Zealand, while small, demonstrates the capacity to continually expand the group’s testing lines.

HRL is also investing in a joint venture with Milk TestNZ called Food Lab that has just commenced trading and will begin with a focus on the NZ dairy industry.

Management estimate Food Lab’s market opportunity is around NZ$40 million with two main competitors.

Snaring a third of this market would be material given HRL’s current revenues of around $35 million.

A New Strategic Playbook

It is very difficult to succeed if you don’t know your destination or the steps to get there.

One very positive element of HRL’s FY21 result was the clear presentation of a three-year strategy roadmap anchored on organic growth.

This will require reinvestment, but we are willing to back management to use shareholder capital wisely and drive value-accretive growth.

Outside the core laboratory and consulting services outlined above, HRL has also secured baseline volume work to underpin its laggard geotechnical testing arm and is live to the opportunity in its software business Octfolio.

Octfolio’s hazardous materials, workplace safety, and field management software generates just under $1 million in revenue.

At that size, it has proof of concept and customer validation but is immaterial to earnings and valuation.

With a reenergised sales focus Octfolio could become a significant, and high value, revenue stream.

Its current contribution is not valued by the market, so the upside is large relative to any downside.

In Stormy Seas look to the Helmsman

Earlier we outlined three growth paths for HRL but failed to discuss one of them: a transformational deal.

Acquisitions can be hugely value accretive, but they can also be hugely value destructive.

The best news is that HRL can self-fund growth via bolt-on acquisitions or organic investment.

But a large deal to bring significant scale could add a lot of value to the company.

We get comfort with this prospect given the track record on M&A and the fact that the chairman of HRL Holdings is Greg Kilmister.

Kilmister was the chief executive of ALS Limited, and took the business from a market cap of less than $400 million to more than $3 billion.

That’s the kind of steady hand that provides comfort in any big strategic moves or tough patches.

Risks to Consider

Growth is not a right and markets are competitive. There are no guarantees that HRL’s organic investment drive will bear fruit.

It is also possible that the share price will suffer near-term as the growth initiatives crimp current earnings ahead of any potential revenue growth.

The company currently enjoys a comfortable niche, but it needs scale to get to the next tier operationally.

Failure to get to scale or a misguided acquisition in the quest to bulk up are two further risks to our investment thesis.

The information in this article is current as at the date of publication and is provided by NovaPort Capital Pty Ltd ABN 88 140 833 656 AFSL 385329 (NovaPort), the investment manager of the NovaPort Smaller Companies Fund ARSN 094 601 475 and NovaPort Microcap Fund ARSN 113 199 698 (the Funds). It is intended to be general information only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider the applicable disclosure document or product disclosure statement (PDS) and any additional information booklet for the relevant Fund before deciding whether to acquire or continue to hold an interest in the relevant Fund. The relevant PDS can be obtained from your financial adviser, Fidante Partners’ Investor Services team on 13 51 53 or website www.fidante.com.au. Please also refer to the Financial Services Guide on the Fidante Partners website. Past performance is not a reliable indicator of future performance. Neither your investment nor any particular rate of return is guaranteed. Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante Partners), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante Partners in relation to the Funds, Fidante Partners is not responsible for the information in this publication, including any statements of opinion The information is not intended to be relied upon as a forecast or research and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy, nor is it investment advice. Neither of Fidante Partners nor NovaPort makes any representation or warranty as to the accuracy of the data, forward‐looking statements or other information in this material and shall have any liability for any decisions or actions based on this material. Neither of Fidante Partners nor NovaPort undertakes, and is under any obligation, to update or keep current the information or opinions contained in this material. The information and opinions contained in this material are derived from proprietary and non‐proprietary sources considered by Fidante Partners or NovaPort (as applicable) to be reliable but may not necessarily be all‐inclusive and are not guaranteed to be accurate.