An Eruption of Disruption?

Sinclair Currie, Principal and Co-Portfolio Manager

Market Recap

Following a blistering 3.7% rise in May, the Small Ordinaries Accumulation Index delivered another positive month in June with a 1.0% gain. The market shrugged off concerns surrounding geo-political risks, tightening monetary policy and the sustainability of low volatility. The small cap benchmark delivered a strong 24.25% gain over the 2018 financial year.

The small resources aggregate delivered stronger returns than industrials during the year. Stronger energy, battery materials and base metals prices all provided impetus for the rally and resource services businesses also benefited from renewed investor interest.

Within the industrial sector out performance was concentrated in relatively few names, evidenced by a median return less than half the average return for the sector. Despite a strong representation of technology and infant formula stocks within the top performers, we believe earnings revisions were the dominant common factor explaining stock outperformance during the year.

Companies were richly rewarded for earnings outperformance, enjoying disproportionate increases in price relative to earnings. As such the market enters FY19 with a subset of companies trading at substantially higher multiples than they did a year ago and with elevated earnings expectations for the year ahead. This has meaningfully raised the stakes leading into the forthcoming earnings season and investors will be looking for strong guidance to justify current multiples in these names.

An Eruption of Disruption?

Disruption continues to be the word of the moment. The media sector highlights how new business models can decimate the value of old platforms. Investors are rightfully alert to the redundancy risk associated with established business models and rightfully eager to invest in the leaders of the future. Yet some current commentary suggests that disruption is a new ‘theme’ which investors should gain exposure to at any price, a view we find overly simplistic.

History shows disruptive businesses and technologies have always emerged. While speedy access to data networks might debatably be driving an increase in the number of disruptive opportunities, it does not logically justify that investors should pay a higher premium to speculate in these opportunities just because there are more of them.

Investment fundamentals have not changed. Each additional dollar premium paid for an investment implies greater confidence in the future compensation from that investment. The market is rewarding emerging and disruptive businesses with high valuations, suggesting a high degree of confidence in the outlook for these companies. Yet we have not seen any evidence suggesting investors are better at predicting the future than they were in the past. We suspect overstated confidence is what supports current valuations.

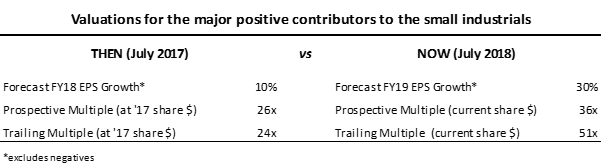

We looked at the leading contributors of the small industrials over the past year and found that over two thirds would be classified as ‘disruptors’. We also reviewed how the fundamentals underlying these leading contributors had changed over the year. Earnings expectations for these companies lifted by an average of 20% during the year (i.e. last year’s forecasts were hopelessly wrong). As a group these stocks saw their value more than double in the last year, significantly disproportionate to the earnings revisions. These companies are now trading at twice the trailing multiple of earnings (50x) that they were one year ago and at 36x, their prospective earnings multiple is 40% higher than it was a year ago. Achieving that 36x prospective multiple will require the companies to deliver FY19 earnings growth of 30%.

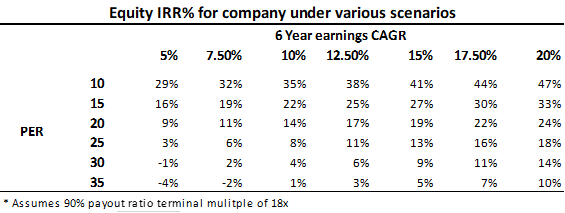

What sort of growth justifies a multiple in excess of 30x earnings? The answer depends not just on the rate of growth however also how sustainable that rate is and how much capital the company requires to generate that growth. The below matrix gives a simple guide. It was prepared assuming a high quality business which can maintain a 90% payout ratio and justify a terminal multiple of 18x earnings into perpetuity. Assuming a hurdle equity IRR of about 15%, an investor would want to see that company triple its earnings over six years (CAGR of 20%) to justify purchasing a company trading at 30x.

So how realistic is it for a company to double or triple its earnings within six years? We tested recent experience by looking at the earnings growth for the 230 largest industrial companies over the past six years. We found a respectable 41 companies delivered earnings per share growth in excess of 20% annually for the first three years (from 2011 to 2014) however for the subsequent three years from 2014 – 2017 the performance diverged significantly. Nearly 40% of these formerly highflying companies saw their earnings decline over the subsequent three years.

To our minds current valuations suggest a high degree of confidence that companies which have generated strong earnings growth will continue to do so for many years to come. Yet history shows us that few businesses can sustain extraordinary growth rates indefinitely. Gravitational forces such as capacity limitations, technology shifts, competition and regulation become more powerful as the mass of a business grows – until ultimately the disruptor risks becoming the disrupted.

A fantastic FY18 has inspired the market to expect another great year ahead. Last financial year’s best performing small companies are expected to deliver 30% earnings growth in FY19. The disproportionate increase in valuations for these companies suggests that the market’s confidence in these estimates has increased. Yet we see no evidence to support the idea that consensus estimates are any more accurate than they were at the beginning of FY18 – estimates which were (for these stocks) spectacularly inaccurate.

The forthcoming earnings reporting season will provide an interesting test of the market. Prevailing premiums could be sustained or even extended if companies justify the market’s confidence with results and guidance which exceed (already elevated) expectations. On the other hand we see substantial downside should they miss expectations. Ultimately the question is, how reliable are earnings forecasts? Current valuations suggest a level of confidence in their reliability which we do not share.