Let’s face it, we’re all getting older…

Sinclair Currie, Principal and Co-Portfolio Manager

Market Recap

The Small Ordinaries Accumulation Index posted a strong 8.50% return for the September quarter bringing the rolling one year performance to 29.16%. Industrials and resources contributed to the quarterly performance with both sectors up 8.52% and 8.15% respectively.

As discussed in our August update, the key event over the quarter was the release of 30 June earnings reports. To recap, results were generally in line with expectations (notwithstanding the usual hits and misses) with forecasts for the current financial year largely intact. Management commentary would suggest underlying conditions for the economy are relatively solid. Consumer and business confidence levels are supported by strong housing construction related activity as well as low interest rates, petrol prices and unemployment level. The absence of inflationary pressures across the broader economy saw the Reserve Bank cut interest rates by a further 25 basis points in August which will serve to keep the Australian dollar competitive thereby supporting import competing sectors.

Apart from economic and financial conditions, a key driver of share prices over the quarter was increased investor interest in lower priced value stocks at the expense of premium growth companies. This dynamic was reflected across capital markets globally with the prospect of higher interest rates (or at least the end of aggressive monetary stimulus driving down rates) prompting a switch from defensives, long duration growth stocks and bond type yield proxies (e.g. utilities, telecommunications companies and property trusts) into cyclical companies that have largely been ignored over the last 18 months.

Let’s face it, we’re all getting older…

Understanding demographic trends is an important part of forming a view on the outlook for the economy as a whole as well its component sectors and industries. The inevitable aging of Australia’s population poses risks and opportunities, not just in the future but also immediately. The short term relevance of our aging population is borne out by shifting policy and regulations as governments prepare to address future challenges. In this edition we take a look at longer term age related demography and consider investment themes which might arise from them.

The Australian Government Productivity Commission’s paper ‘An Ageing Australia: Preparing for the Future’ outlines how Australia’s population is expected to age, the challenges this creates and some ways governments can prepare for these challenges. In our view its key findings were:

- Assuming the fertility rate and immigration intake do not change substantially, Australia’s population is expected to grow to about 38 million by 2060. Longevity is a dominant driver of population growth, assuming lower migration and fertility the population would still be expected to exceed 34 million.

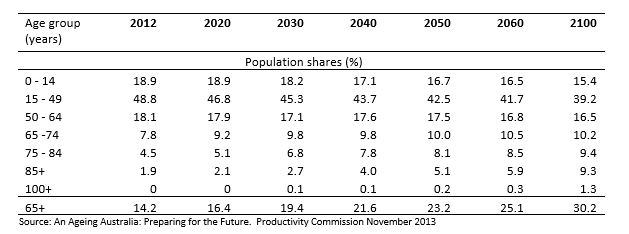

- The fastest growing age cohort is expected to be Australians aged over 65, from 14.2% of the population in 2012 to 25% by 2060. The proportion of Australia’s population aged 15-65, (the cohort capturing the majority of the labour market) is expect to shrink the most, with a smaller decline in the proportion 0-15 year olds. This shift has already started in earnest and as baby boomers are now reaching retirement the growth of the ‘non-working’ population is expected to peak during the next 14 years.

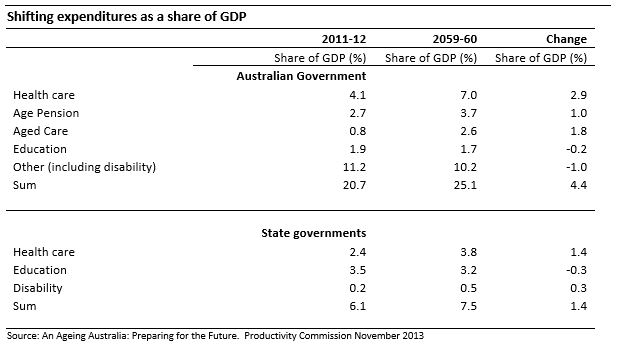

- The impact on federal and state budgets is expected to see Federal government spending requirements increase from 21% to 25% of GDP and state governments from 6.1% to 7.5% of GDP. Aged care costs will grow at the fastest rate however Health care costs will continue to grow fast and will remain the largest area of expenditure, followed by the aged pension.

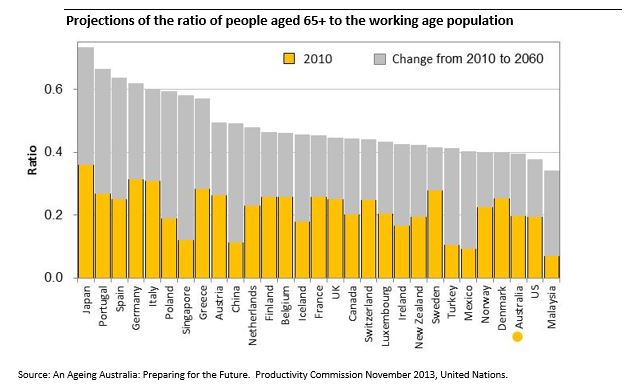

- And finally, due in part to its positive immigration rate, Australia’s demographic shift appears less acute than most other OECD countries.

So what does this mean for investors?

We believe investors will have to be alert to how Governments are positioning themselves to address these challenges. The growing demands on budgets will require continued policy response, and this is an area of live debate. The report outlines five policy levers available to government, 1) enhancing productivity, 2) cutting from other areas, 3) raising taxes, 4) rationing services and 5) requiring more private funding of services. The table below sets out the main areas of expenditure as a share of GDP, highlighting areas where the government might focus its mitigation strategies.

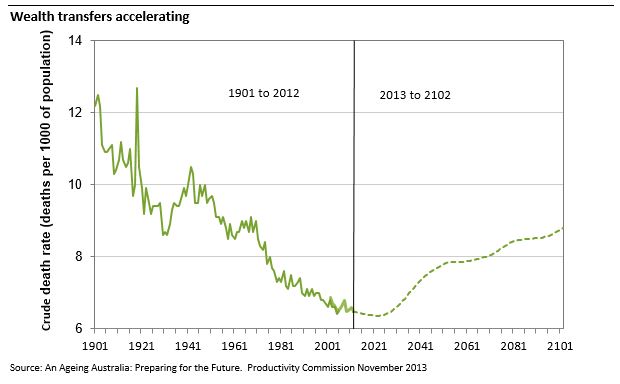

In all likelihood we would expect governments to utilise a combination of approaches to minimise their expenditures and believe this will create further regulation and complexity. As a result we expect growing demand for advisory services, whether it be tax, retirement and aged care planning or wealth advice (as an interesting aside, over $400bn of housing wealth is expected to be inherited between 2011 and 2025).

Over the medium to longer term changes in demographics will gradually accumulate to substantial shifts in demand for differing goods and services and investors have time to position their portfolios for these changes. It appears likely that the obvious outcomes, such as increases in demand for pensions, aged care and health care, will be met by continued government expenditure curtailment strategies.

Population growth is expected to be sustained for the foreseeable future and we believe this is in itself an important thematic driving demand for housing. We believe 170,000 new dwellings a year is a conservative estimate of the underlying construction task required to support Australia’s population growth. Without ignoring the cyclical nature of the housing sector, a solid base of demand is an encouraging start to any investment thesis.

Australia’s major cities are expected to see continued strong population growth, and the report predicts that Sydney and Melbourne’s populations are each expected to expand by over 3 million over the next 45 years. This will drive demand for investment in physical infrastructure and social services such as public transport, roads, hospitals etc.

Finally it would appear to us that Australia is relatively better placed (at least demographically) than many other developed nations. Australia has a productive workforce which appears likely to remain better resourced relative to many other OECD countries. The Australian labour market has potential to improve its attractions as a destination for knowledge and service based industries seeking a secure supply of highly productive employees.

Conclusion: age, tax and regulation are inevitable. Advice and solutions will be needed

In summary, the scope of the opportunities and challenges arising from demographic trends are significant and this review only touches briefly on a few of them. We are alert to identifying short term investment opportunities and risks in areas where population projections intersect with government planning and policy. More policy and thus regulation appears inevitable and consumers are likely to be burdened with greater complexity, resulting in opportunities for organisations providing appropriate advice, services and solutions.