SAI Global

Sinclair Currie, Principal and Co-Portfolio Manager

SAI Global offers a diverse range of products and services to businesses seeking to manage their regulatory compliance as well as providing outsourced transactions services to the property sector. Demand for its services is driven by increased societal and regulatory imperatives for businesses to demonstrate their operations comply with standards of best practice.

SAI is held in the NovaPort Small Companies Fund. We highlight the following positive attributes of SAI’s businesses;

- Exposed to growing markets. Globalisation, regulation and standardisation all require companies to continue to invest in compliance and quality assurance programmes. Increasingly globalised operations have exposed many businesses to new risks (e.g. quality control through supply chains in the food industry) which they have to monitor and manage. SAI is well placed to provide these services.

- Quality franchises. Much of SAI’s services are used by clients seeking to mitigate and manage risk. As such we believe clients are positively predisposed to the scale, capability and reputation of incumbents, providing some competitive advantages.

- Reinvigorated management and strategy. Historically SAI grew via strategic acquisitions with limited subsequent integration into a cohesive market presence. New management have taken steps to align the businesses into a more coherent structure and are investing in systems to deliver services to clients more efficiently.

We also highlight the following risks;

- A part of SAI publishes and distributes the standards developed by Australia’s peak standard making authority, Standards Australia. The company currently generates generous margins on this business which will fall substantially in the next few years.

- Australia is experimenting with electronic property settlement exchanges, which would cannibalise a part of SAI’s property services business. However the adoption of electronic settlement has been weak, and SAI has expressed some interest in exploring business opportunities in this value chain.

- SAI failed to deliver meaningful organic growth at its most recent result, with some blame being placed on the restructuring process. There is some debate whether management will be able to resume growth, at least in line with market.

In conclusion

In our view SAI Global is a quality business exposed to growing markets and has traditionally has attracted a premium valuation for these attributes. Concerns surrounding its publishing business and organic growth have seen the company recently trade at a discount to market valuations. We are at odds with this discount as we see merits in its strategic initiatives and considerable opportunities in its markets.

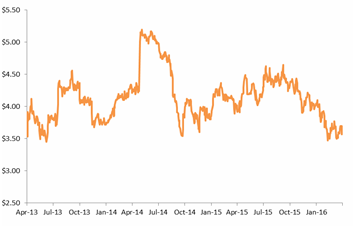

SAI Global – share price chart

Source: IRESS