Markets prefer certainty, but at what price?

Sinclair Currie, Principal and Co-Portfolio Manager

Market Recap

The S&P/ASX Small Ordinaries Accumulation Index finished up 1.03% for the March quarter. While the increase was not material, intra quarter volatility was significant with the index down almost 10% at one point reflecting the performance of the industrials sector. Meanwhile, resources companies posted a very strong performance up 17.3% for the three months to 31 March making it the strongest quarter for the miners since September 2013.

As always, the March quarter is important given it includes the February reporting season where companies release results for the first six months of the financial year. Notwithstanding overall earnings forecasts for the smaller companies sector were downgraded the number of companies and the quantum of earnings changes reflects a stabilising, if not growing economy. Low interest rates, a weaker Australian dollar compared to the last few years, low petrol prices, strong housing related activity and solid consumer and business sentiment levels underpinned reported corporate earnings. Overall, while an earnings upgrade cycle may not be imminent, the Australian economy continues its transition from over reliance on mining to a broader spread of drivers.

As mentioned, reporting season tends to be the key driver for the March quarter, however this time around international news flow was the main factor behind intra period volatility. Key issues included a resurgence in resources on decreasing fear of a hard landing in China and the US Federal Reserve moderating its tightening bias to counter implementation of negative interest rate policies by other central banks as well as concern capital market ructions could potentially derail the US economy’s recovery. Locally, despite a weakening trend since 2011, the Australian dollars 16% gain over the quarter as well as the government’s decision to bring forward the budget potentially leading to an earlier than expected election also played on investor’s minds.

Despite these macro (and largely stock market related) issues, outlook statements by companies over February as well as generally benign economic conditions suggest the outlook for corporate earnings heading towards the end of the financial year is not pessimistic and certainly better than that of recent years.

Markets prefer certainty, but at what price?

Over the last year investors have endured relatively turbulent markets. Shifting expectations regarding the future direction of global economic growth, central bank policy, rapidly changing technologies and regulations all appear to have increased perceptions of uncertainty. This uncertainty has resulted in the fragility of investor, consumer and business sentiment we see today. In our view, this has driven investors to seek out stocks which they perceive offer fewer earnings risks, and as a result these companies share prices have become more expensive and, paradoxically, more risky. In our experience sentiment and risk perceptions are fickle and we remain focussed on identifying companies which can create value and operate sustainable business franchises.

Volatile macro driven markets

The equity market has held its ground over the past year, yet despite the increased volatility for our sample of Australian small companies the distribution of annual returns was narrower over the past twelve months than it was during the period prior to that. Perhaps suggesting macro issues have been a greater driver than company specific over the last year. We have also observed that investor interest appears to be concentrated in relatively fewer companies with the inevitable result being expanded valuation multiples for those increasingly crowded trades.

Valuation dispersions increasing – investors chasing certainty

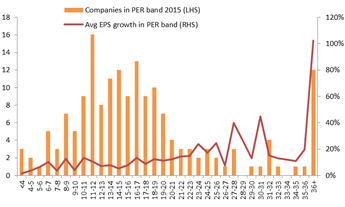

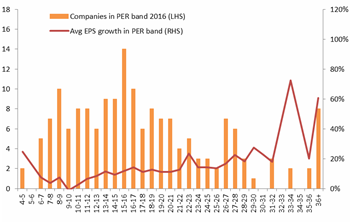

The two charts below show how the PER dispersion of our sample of small companies has increased since 2015. A comparison shows the distribution for 2016 has flattened relative to 2015, suggesting that investors are more willing to hold stocks with valuation premiums. We also observe that the gradient of the EPS growth predicted for each PER band has not shifted demonstrably. This suggests to us that investors are paying a premium for earnings certainty as well as earnings growth.

PER distribution 2015

Source: IRESS, NovaPort Capital

PER distribution 2016

Source: IRESS, NovaPort Capital

So what might explain this increased dispersion? We believe the rationale investors use to justify premium/discount valuations can be broadly defined as

- variances in business quality (for example, how well a company can translate accounting profits into sustainable dividends),

- earnings growth (the future prospects of the company) and

- earnings risk (the likelihood that the company does not meet or exceed expectations).

We believe there is considerable friction holding perceptions of business quality steady, hence do not think this is a meaningful driver of increased valuation dispersion. As for earnings growth, when we compare the two charts the gradient of the earnings growth line does not appear to have shifted substantially, suggesting to us that investor preference for growth has not altered substantially. This leads us to conclude that the increased dispersion of valuations is best explained by investors seeking lower earnings risk. We see a flight to earnings certainty as consistent with the current cautious sentiment and a lack of clear economic momentum to support broad based profit expansion.

Crowded trades raise the stakes

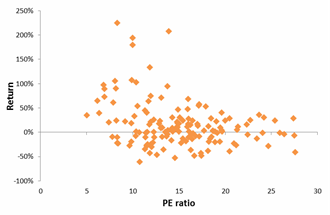

However we caution that the higher prices now being paid for these companies has driven valuation disparities, which in itself elevates investment risk should market perceptions of certainty not be borne out by reality. Market perceptions of quality, certainty and growth are all prone to shift and to illustrate this point, in the below chart we plot the past year’s share price returns against price to earnings ratios. What this highlights is that while high PER’s might indicate quality, certainty or growth, however they don’t guarantee future performance.

PER vs Return

Source: IRESS, NovaPort Capital

Conclusion

To our minds identifying good investments (and avoiding bad investments) is not a matter of choosing those companies which the market already perceives to have the highest quality, the lowest earnings risk or the highest growth (and vice versa). The challenge is to correctly identify when the market’s perception is changing and assessing how sustainable that shift in perception will be. To that end, we remain wary of the risks posed by investing in ‘crowded trades’ and remain alert to opportunities where the market is still forming a consensus.