Venture Capital. Flying unicorns or an elephant in the room?

Sinclair Currie, Principal and Co-Portfolio Manager

The growing popularity of Venture Capital (VC) has enabled some remarkable and innovative businesses. The attractive returns of many VC funds have stoked further investor appetite for their aggressive growth strategies. Today some of the world’s most highly valued companies are neither listed nor profitable. Furthermore, in response to the competitive threats from VC backed disruptors, established businesses are now also adopting VC inspired investment and R&D strategies.

The outstanding growth and share price performances of companies like Amazon, Atlassian and Tencent is well known and the rigours of being a public company means they are financially transparent and broadly understood. Similarly, the growth ambitions of unlisted VC backed groups such as Uber, WeWork and Airbnb are also well known. Yet lacking the sustained transparency and scrutiny of public markets, the understanding of their financial sustainability is narrower.

The valuations implied by the substantial private market capital raisings these companies have made are enormous. Despite the massive valuations, these companies often incur enormous losses to generate growth and therefore have been nicknamed ‘unicorns’ – i.e. a mythical beast. There is little modest about VC unicorns. They invest heavily with bold ambitions.

The Venture Capital sector is bigger than ever yet remains fundamentally illiquid and opaque. Valuations are benchmarked on deals which are conducted behind closed doors and upon terms which are not fully transparent. Rather than chase unicorns, we believe the cyclical anatomy of this investment cycle is an elephant in the room investors must consider.

How big?

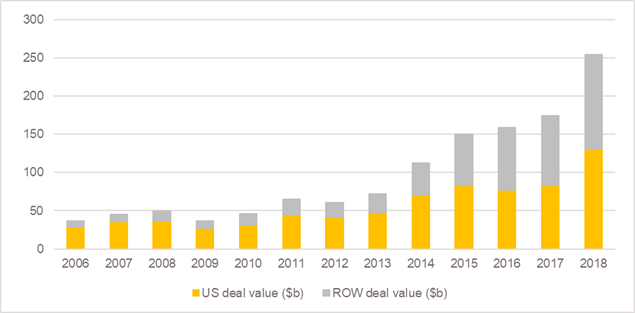

The VC sector has expanded fast. The US based National Venture Capital Association (NVCA) 2019 yearbook estimates VC deal value of US$254 billion globally in 2018, of which about half (US$131 billion) was in the USA alone. This number does not seem particularly large relative to global GDP (~$87 trillion) or even US GDP (~$19 trillion) but this investment has an outsized impact on the economy[1]. In particular through its huge impact on job creation. Some studies estimate that start-ups account for about 20% of US job creation however in the past subsequently high failure rates of start-ups created a meaningful churn[2].

Venture capital deal value $USbn. USA and Rest of World (ROW).

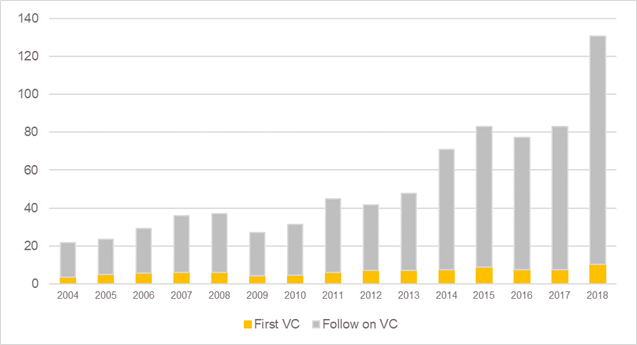

More recent statistics indicate that start-ups are being given more leeway by investors which suggests job security at a start-up is better than ever. According to the National Venture Capital Association, the dollar value of total VC financings grew six fold since 2004. However the value of ‘follow on’ VC deals grew at twice the pace as ‘first round’ financing. VC Investors are providing more support for longer periods of time. In 2018 ‘follow on’ deals accounted for $120 billion, over 90% of VC deal flow. We believe this secures start-ups from failure and thus boosts net job creation, which is powerfully multiplied as these dollars are spent by employees and recycled through the economy.

US Venture capital deal value US$bn, first VC raise (orange), follow on rounds (grey)

Having your cake and eating it too

The economic stimulus provided by VC investment doesn’t stop with job creation. There is also a wealth effect as the valuation of these businesses has grown. Many of these companies have continued to invest heavily into aggressive growth strategies long after their IPO’s and stock market investors have been strong supporters. Emerging out of this has been a positive feedback loop of expanding valuations for listed and unlisted companies. Investors have been richly rewarded for prioritising revenue growth over profit maximisation.

Current high valuation multiples at which growth companies trade implies that investors are confident profits will ultimately be generated from spending big on growth initiatives. The economy is enjoying the stimulus of VC (and VC inspired) investment while investors are benefiting from rising valuations. It seems we can have our cake and eat it too.

Themes – Smartphones, Cloud, Artificial Intelligence

We believe common themes underly many of today’s exciting start ups. Firstly, the advent of the iPhone over a decade ago has created endless opportunities for disruptive new business models based on the smartphone. Entertainment and news companies had to invest in order to adapt to this new medium. Established network businesses such as Taxi companies saw new competitors appear in the form of Uber and Lyft. Services and software companies such as MYOB faced new competitors (Xero) with solutions more easily adapted to mobile devices. In many cases the disruptor companies now attract far higher valuations than the established businesses.

The computing evolution into cloud infrastructure and services has been another theme attracting significant investment and driving capital expenditures which have boosted the economy. The smartphone revolution and changing IT strategies have seen companies invest heavily in new system architectures centred on the ‘cloud’ where services are bought from third party data centres rather than the business’ proprietary computing resource. This has created demand for physical infrastructure as well as new software and service solutions.

The so called ‘third wave’ of the technology evolution is Artificial Intelligence (AI). From endless customer service ‘chatbots’ to self – driving cars, billions are being spent on logic and advanced automation, often harnessing the boom in computer processing power provided by the huge investment in cloud infrastructure. Once again, these invested billions are boosting the real economy as well as the earnings of service providers to AI developers.

How does this impact on Australia Small Companies

Change has created some fantastic opportunities and the VC boom has rearranged the Australian Small Companies sector. Software businesses listed on the ASX and seen their valuations surge, Entertainment and media companies have seen their valuations decimated as they have lost audience and advertiser share to new competitors. It is difficult to find of a business which has not invested some form of smartphone application or cloud based technology.

We identified thirty meaningful companies in our Small Cap ASX listed universe which are pursuing growth strategies aligned with those observed in the venture capital space. The average market capitalisation of these companies is $1.4 billion. The aggregate capitalisation of these companies exceeds $46 billion. These companies contribute to the economy via job creation as well as of wealth effects. They are not insignificant it is likely that most super funds will have some exposure to these names. The durability of their valuations and growth strategies is a meaningful variable driving the outlook for the broader market, and we suspect the economy.

How sustainable is it?

Meaningful changes to technology have driven huge opportunities and threats in the broader economy as well as the small cap universe. Recent technology innovations are here to stay, however that does not mean there isn’t an element of cyclicality within this process as investors and businesses pause to reflect on the outcomes of their investment programmes.

To illustrate how there can be cycles within longer term investment themes we recall the 1999 dot.com boom. The internet was a forceful disruption which initiated major

technology investments, stimulating the economy as companies prepared for ecommerce. Some of Australia’s best known and most profitable companies were born during this period (e.g Seek REA Group). Many more no longer exist (e.g Libertyone, Eisa). Ultimately successful investing came down to stock selection however no company avoided a hangover after the market’s initial excitement waned. The below chart shows how REA Group, despite a strong business model, fared in the aftermath of the dot com bubble bursting.

REA Group – it took 4 years to recover IPO share price high

Another factor to consider when assessing the sustainability of the Venture Capital boom is how these investments work within a broader portfolio. VC investments are typically less liquid, have less transparent corporate governance and (often being loss making) suffer greater risk of dilution via subsequent capital raisings. We believe this places limits on how far many portfolios can prudently raise their weightings towards the VC sector and ‘VC like’ loss making listed companies.

The recent listings of companies such as Uber, Lyft and Pinterest indicate a maturing of the boom. Once escrow restrictions cease investors in these companies are likely to take advantage of public market liquidity to recycle and realise their capital. Also, as listed companies, management will have less capacity to control their cost of capital should they need to raise in the future. Finally, the performance of these companies post listing will test the reliability of the valuations quoted for unlisted investments.

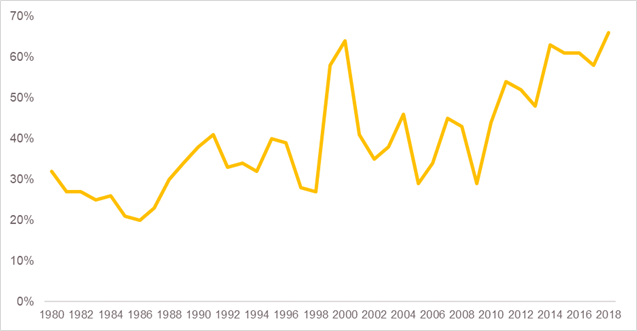

Share of IPO’s backed by Venture Capital (USA equity markets)

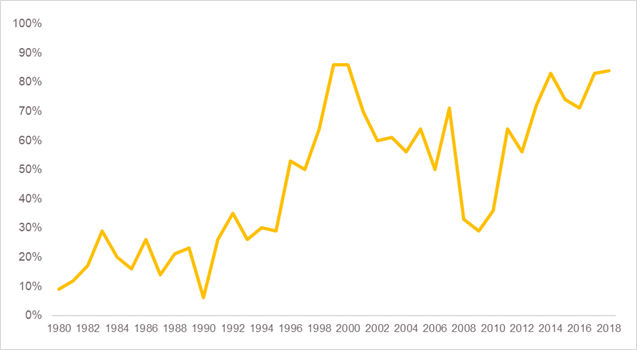

Share of IPO’s which are not profitable (USA equity markets)

The Venture Capital boom has captured much of the excitement and many of the opportunities associated with significant changes in technology over the past decade. The sector has a meaningful economic weight. The Australian Small Companies Sector is also substantially exposed to these themes. The investment surge associated with all this has supported economic growth and generated significant wealth effects. Now loss making ‘unicorns’ are being listed on public markets. The increased number of listings and poor earnings track record of these companies indicate to us that this is a mature investment cycle. We believe investors and policy makers need to consider the risk that the investment boom associated with this maturing cycle slows.

1 “The Role of Entrepreneurship in US Job Creation and Economic Dynamism.” Journal of Economic Perspectives, 28 (3): 3-24.

2 IBID