Aged Care – elderly who are expected to live for longer

Sinclair Currie, Principal and Co-Portfolio Manager

Market Recap

The Small Ordinaries Index fell 2.45% over the December quarter which was the first down quarter since September 2015. The resources and industrials sectors both contributed to the decline, down 1.7% and 2.63% respectively. Despite a weak quarterly finish to the calendar year the benchmark index finished up 13.18% over 2016 marking the best year for smaller companies since 2010 (up 13.05%).

The December quarter was notable for a number of political and economic events. By far the most topical was the election of Donald Trump despite pundits dismissing prospects for such an outcome over the months leading up to election day. Equity markets worldwide rallied on confirmation of the victory spurred on by the stimulatory benefits of prospective infrastructure investment programmes, tax cuts and roll back of regulations imposed over the last few years by the outgoing administration. The other notable event over the quarter was sharp increase in the 10 year interest rate in the US. While there has been commentary that a Trump victory will be inflationary, debt funded and therefore likely to drive up interest rates we note the US 10 year bond yield had already started to rallying in early July reflecting the Federal Reserve’s drift from a dovish to more hawkish stance thereby setting the foundation for a ramp up in rate rises over the medium term.

These macro dynamics influenced the smaller companies market locally with the prospect of higher interest rates (bad for high multiple stocks) and bullish sentiment regarding the US economic outlook combining with generally positive economic conditions here to underpin a continuation of the rotation from highly priced growth companies into what were previously ignored cyclical opportunities. While economic conditions are generally viewed as positive, a weak September quarter GDP report added a cautionary note towards the end of the year. However, whether this is followed by more weakness over the December quarter will be largely dependent on Christmas trading for the retailers and will become clearer towards the end of January.

Last quarter we discussed aging, this quarter we consider aged care

The Australian residential aged care sector has come under persistent scrutiny from a federal government eager to extract savings. The cuts began with termination of the payroll tax supplement in the 2014/15 budget and continued with further funding constraints in the 2016/17 budget. Most recently, following consultation with sector, some modifications to the budget measures were announced in December 2016.

Government funding cuts have scared off investors

In Australia the federal government provides 70% of the funding for residential aged care therefore changes to federal funding arrangements have a substantial bearing on profitability of aged care providers. Alarmed by the scope and persistence of funding cuts, investors avoided residential aged care operators (Regis, Japara and Estia) and some opened short positions in the sector. Since the budget modifications were announced the share prices of the listed operators have recovered however remain significantly below their pre-budget peaks.

However the need is still there

Significant projected budget deficits means investors should expect the government to remain vigilant in mitigating cost inflation from the aged care sector. However we believe the fact an agreement was reached to modify the announced budget measures was significant. It indicates the government is committed to ensure the sector is viable and capable of investing to meet future demand. This is consistent with our belief that aged care is akin to an essential service. Elderly people and their families probably do not plan to use residential aged care however they expect it to be available when they need it.

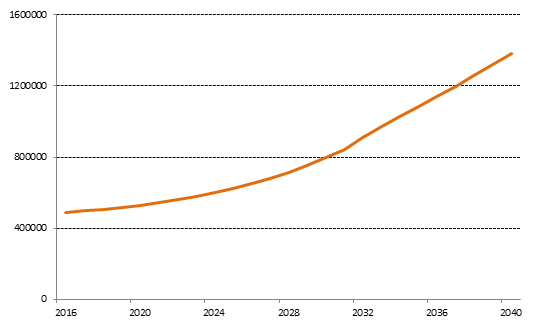

To us it seems very likely that demand for residential aged care services will continue to grow at an elevated rate. Demographics project a growing population of elderly who are expected to live for longer, indicating demand for aged care services well in excess of the current capacity. Some estimates project a need for a further sixty thousand placed, up from just under two hundred thousand currently.

Growing demand: Projected number of Australians aged over 85

Source: ABS 3222.0 Population Projections, Australia

Substitution risks are low

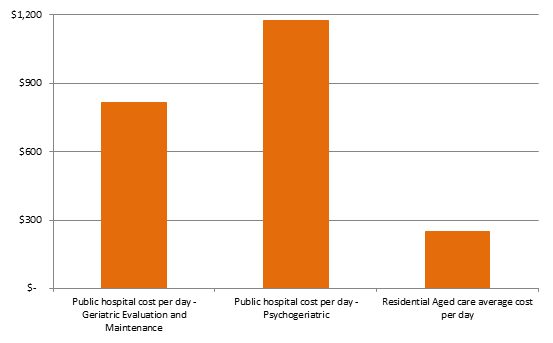

There are few viable alternatives to residential aged care. Sadly frailty and degenerative diseases in the later stages of life mean many people require high levels of care on an ongoing basis. Residential aged care provides a tailored and sustainable continuum of care compared to the alternatives of home based care or general hospitals. A hospital’s delivery of care and funding is generally geared to providing treatment for specific ‘health episodes’, at odds with the ongoing care and lifestyle needs associated with aging. As for home based care, it is difficult to see this effectively displacing residential aged care for the often round the clock needs of the very frail.

Cost of care, public hospitals vs residential aged care

Source: Independent Hospital Pricing Authority, “Australian Public Hospitals Cost Report 2013/14 Round 18”. Regis, Japara, Estia Annual Reports.

After the shock, opportunities emerging

In conclusion regulatory pressures will persist for the sector however there is underlying growth and it appears that government is willing to foster a viable sector in order to meet ongoing demand. After a significant fall in share prices, exacerbated by short selling, the sector appears to offer some stock specific opportunities from current levels.